Hindle Reman has been in business since 1941. Adam Hill talks to the UK firm’s Craig Barrow about just why there is remanufacturing money in landfill gas – and what happens when it runs out

Hindle Reman is based in Bradford, Yorkshire, in the north of England. This area was the cradle of the Industrial Revolution in the 18th and 19th centuries, with a rich manufacturing and engineering history – and there is still plenty going on in remanufacturing now too.

Hindle was started in 1941 – a year which will ring bells for US readers of ReMaTecNews since it is when APRA was set up too. Not surprisingly, since this was during World War Two, Hindle (like APRA) was involved in work for the military. “It morphed from there,” says the company’s sales manager Craig Barrow. “We’re a machining company, first and foremost. Components are our ‘bread and butter’.”

These days Hindle gets about 60% of its revenue from remanufacturing…but not just any form of reman. It is heavily involved in quite a specific sector: the company remanufactures components – although not whole engines – for manufacturers which produce engines to generate electricity from landfill gas (LFG). This is a niche industry, which extracts the gas created by decomposing matter on rubbish heaps.

As such, it is a brilliant fit for reman’s green credentials: LFG is toxic if it escapes – so turning it into clean renewable energy, which can be used to generate electricity, for instance, represents a particularly virtuous circle.

If it were easy, then everyone would be doing it. But it’s not easy: this is the heavy end of the business, representing 60-70% of Hindle’s reman work; much heavier, even, than the bus and truck work which make up the other 30-40% – and certainly a far cry from automotive reman. “We totally keep out of car stuff,” says Barrow. “Unless you’re doing mass volume, it just doesn’t pay. You’re on a hiding to nothing, to be honest. There’s a lot of competition: it just doesn’t stack up.”

Expensive monsters

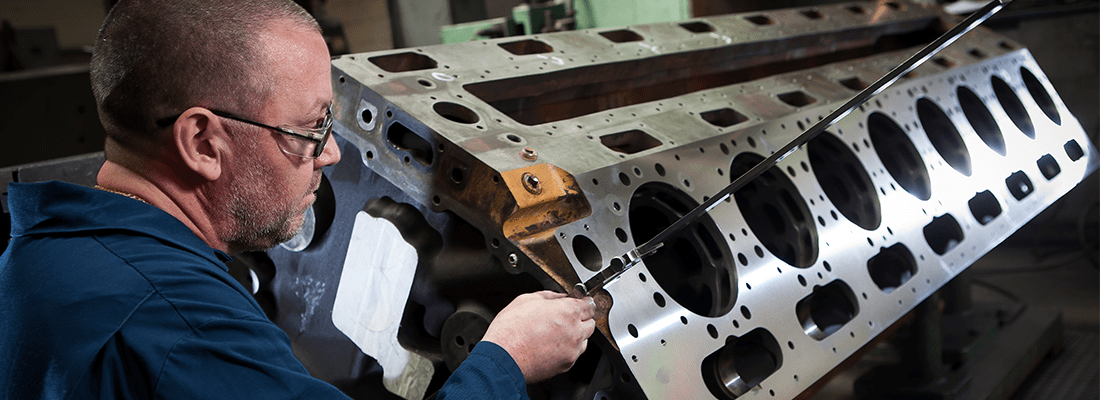

This means that big is certainly beautiful as far as Hindle is concerned. For example, it does a lot of work on the LFG engines produced by Jenbacher. The cylinder block alone on the Austrian manufacturer’s J620 GS unit weighs a hefty 5.5 tonnes – and the complete engine considerably more. That takes some shifting, even before you get to a point where you can work on them.

Most people couldn’t physically do some of the things we do,” says Barrow. “It’s major undertaking to move the things about, let alone machine them! It definitely sets us apart from other companies.”

These monsters are very expensive. To give you an idea, companies regularly spend in excess of £200,000 just to overhaul them – which means to buy one new is a real bank-breaker. In turn, this means that there is another reason for remanufacturers to pursue them: it is profitable. “It’s fair to say, the bigger the engine the more than can be done with it,” Barrow says.

Hindle’s remanufacturing work is always carried out in Bradford, with 23 people (including 16 engineers) dedicated to reman, out of 180 people across the group as a whole. “We’ve had more staff in the past – but we’ve probably not done more work! The number of jobs we do is probably less than it was 20 years ago – but the amount of work on each one, because of the size of the engines, is considerably more.”

The majority of Hindle’s work is UKbased, which means that Brexit – the UK’s impending departure from the European Union – is not so much of a concern for the firm. “We have one or two customers on the landfill side who have operations abroad,” says Barrow.

“But on reman, 95% is UK-based. We manufacture crankshafts for Europe, but only a small percentage again. I don’t anticipate major problems.”

Other interests

Whatever happens in the geopolitical world, moving from its base in Bradford is not on the cards for Hindle. “We cover the whole of the UK anyway, and the investment to put the machinery somewhere else would be massive,” he continues. “To replicate what we’ve got here would not be beneficial.”

It is good for any business to have various strings to its bow, and the company’s manufacturing work is something that has increased over the last few years. “Manufacturing helps us to support the reman,” Barrow explains. “It gives us additional work, they complement each other.” The company has other interests, too, such as being the UK distributor for Interstate-McBee, the US-based parts supplier.

When life began during wartime, Hindle was called Hindle Auto Products and has changed its name a couple of times. Hindle Reman as a moniker works well for the remanufacturing side of the business, of course, although Barrow says it might be “a bit out of kilter” for other parts of the operation. But time will tell.

Barrow himself is no stranger to change, and has seen a lot since joining the company 30 years ago, following his apprenticeship at another outfit. “At that time, 75% of work was on bus engines,” he recalls. “That continued for many years – in fact, we only started to look at the really big stuff 10-15 years ago.” Back in those days, Hindle also did a lot of work on cars but – as we have seen – got wise to the opportunities that the heavier side of the business offered. “There was a saturation of people doing car cylinder heads so we couldn’t make money on that,” he goes on. “We made a concerted effort and got involved with Cummins QSV gas engines.”

Three years ago, that interest got even more intense. Hindle put money into a 5m crankgrinder. “We couldn’t have done the Jembacher 620s otherwise,” he says. “It was a significant investment there because we’ve seen the way our customers are going. There’s a big push towards bigger, more productive engines.”

Traditional work

Hindle has more change to look forward to, since the days of landfill sites – at least on the current scale – are numbered. As the principles of the circular economy take hold, there will

(in theory at least) be less and less need for them. “It will eventually disappear,” he concedes. But not just yet. “The thing with LFG is that it’s corrosive,” Barrow adds. “That means it wears out machinery quickly. A set of cylinder heads on most engines will be changed once a year.” With 16-20 heads per machine, “that adds up to big business”.

Waste water operations are also using similar engines, taking the methane gas from sewage. “It’s not on the scale oflandfill yet,” Barrow admits. But that doesn’t mean that it won’t grow… and in the meantime there is plenty of more traditional work to get stuck into. “Truck and bus engines last longer than they ever did,” he goes on. “Reman will be there for as long as diesel engines are allowed. In 30-40 years’ time there will still be a few little companies doing vintage truck engines! Truck engines might go around 2030, but gas engines will be around considerably longer.”

Of course, other technologies are already here – and will certainly be gaining more prominence in the future. However, moving into hybrids and electric vehicles might be a step too far for Hindle at the moment. “It will need some significant thinking about,” muses Barrow. “As yet we’ve not really looked at it. It’s a totally different animal, a completely different ball game – an electric motor repair company would be more into it.”

Reman need

The company might look to diversify its manufacturing operation instead, he suggests. Hindle does a lot of work for OEMs but Barrow says the reman versus new price differential can range from 10% to 50%, depending on the product.

While cores are at the heart of the remanufacturing business, Hindle does not have a problem sourcing them. “About 99% of the time, people bring us the cylinder block, the crankshaft or whatever. That means we don’t have to get involved too much in cores. If we need to buy core we go to core brokers and the like.” Interestingly, Hindle does offer a service exchange scheme on Caterpillar G3516 cylinder heads. Why? “There is a high turnover,” Barrow explains. “It is a very popular engine in landfill and we can do them at a competitive price compared to the OEM.”

So, a lot has happened since 1941. And despite the current disruption to the industry, there is no need for remanufacturers to be downhearted. “We’ve been in remanufacturing for 80 years and we see a bright future for component reman – and possibly even more when engines start to not be manufactured anymore,” he concludes. “People aren’t going to suddenly stop running the vehicles. There will be a need.”