Cars have long contained electrical and electronic equipment. But the rise – slow, but growing - of electric vehicles means reman is on the cusp of change, and survival may mean looking outside of the automotive industry.

For a long time, it has all been relatively simple. The internal combustion engine has been around since the middle of the 19th century. It has a lot of parts that wear out and need remanufacturing. But things are changing. It’s easy to think that electric vehicles (EV) belong to the future, along with jetpacks and hover boots – but they are a big part of the here and now. Two million plug-in electric cars are now believed to be driving the world’s roads, with China, Europe and the US leading the way. That number is set to increase: sales in Europe doubled in 2015 to 145,000 – in Norway alone, one in three cars sold is now electric. The most popular EVs last year were the Nissan Leaf, Tesla’s Model S and the Chevrolet Volt, along with Chinese manufacturer Build Your Dreams’ (BYD) models Tang and Qin (see box: Biggest-selling electric cars in the world). Virtually every manufacturer seems to have its own plans for EVs: for instance, Volkswagen, which has had its own well-publicised difficulties with diesel vehicles, reckons it will have 30 EVs on its books by 2025. Yet 2025 is nearly a decade away, and two million vehicles is really not very many at all in the grand scheme of things.

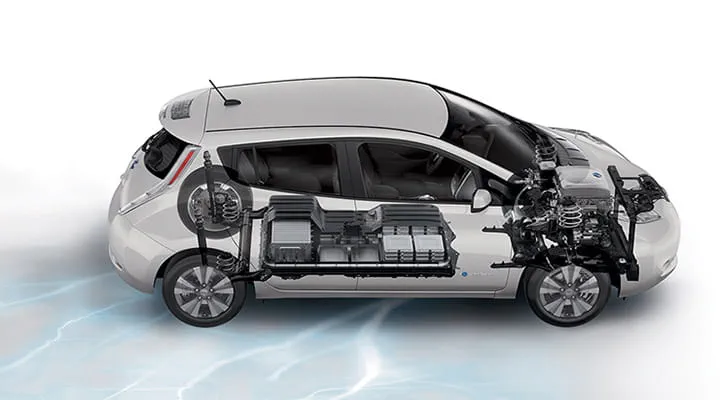

Market-leading Nissan Leaf with standard 30 kWh battery

Customer behaviourHowever, if this still seems like a bit of crystal ball gazing, then consider other technological advances which have created strong popular appeal and a massive change in buying habits. The global ubiquity of smart phones and tablet devices, whose numbers have rocketed in just a few years to the point where it is hard to remember what life was like before them, demonstrates that customer behaviour moves in ways which can be very difficult to predict. The iPad seemed like a neat – but slightly pointless – smaller laptop just a few years ago. Now they are everywhere. Obviously a car is a considerably greater investment, but there is no particular reason why EVs cannot take a similar hold over our lives in the next couple of decades – or even sooner (see box: Barriers to EV take up? They are disappearing). The rise of hybrid cars over the last decade or two has already given remanufacturers pause for thought, although much of the technology is well-known. Hybrid vehicles still use a conventional engine – something that remanufacturers are very familiar with. “If it were just hybrids, then everything would stay the same for reman,” says Craig Van Batenburg, CEO of ACDC, a hybrid and plug-in training company based in Worcester, Massachusetts. “Hybrid cars are just gasoline cars destroying the planet more slowly.” In essence, hybrid powertrains work by recovering energy when driving downhill or when braking: this recovered energy is stored in the vehicle’s batteries and used to power the vehicle in electric mode on the flat roads or low gradients.

Car manufacturers are not the only ones experimenting: Volvo’s ‘Concept Truck’ features a hybrid powertrain - one of the first of its kind for heavy-duty trucks in long haul applications. The vehicle is the result of the Swedish part of a bilateral research project involving both the Swedish energy authority Energimyndigheten and the US Department of Energy – proof that everyone, everywhere is looking seriously at how to reduce emissions and save fuel. For long-distance work, the hybrid powertrain could allow the Volvo’s combustion engine to be shut off for up to 30% of driving time. The manufacturer says this will save 5-10% in fuel, depending on the vehicle type or specification, and its drive cycle. It also offers the ability to drive in full electric mode for up to 10km, enabling the vehicle to operate with zero emissions and low noise. “Using hybrid technology, the potential reduction in fuel and emissions is considerable and an important step towards reaching both our and society’s environmental goals for the future,” says Lars Mårtensson, director environment and innovation, Volvo Trucks. In the Swedish manufacturer’s case, the truck’s hybrid powertrain is partly based on the experience gained from its own hybrid and electric buses.

Hybrid training

The point is: hybrids are now part of the furniture. “Hybrids have been in the US for 17 years and that’s when I started training on them,” van Batenburg continues, recalling his days working with Honda’s Insight hybrid model. “I thought my competition was going to be dealerships.” Instead, he says, it was the manufacturer: Toyota, for example, was willing – and able – to lower the price of Prius battery packs, thus removing some of the attraction of reman in the first place. If a new Toyota one is only $200 more, then you can understand customers opting for brand new rather than going for a remanufactured battery. It is reasonable to think that EVs will follow a similar cost path – and it is certainly worth planning for that to happen.

So what then? There is a major change for remanufacturers in the rise of EVs. “Electric cars have no internal combustion engine,” van Batenburg says. “There is a clear path away from oil towards electricity.” Electric vehicles offer zero emissions and are therefore attractive in a world which recognises that air pollution and resource depletion need to be reduced. The big problem, he thinks, is that electric cars will require only a fraction of the work in the aftermarket compared to gasoline or diesel cars – meaning, in essence, there will be less to remanufacture. Interestingly – and perhaps worryingly - specialist EV manufacturer Tesla has been hiring technicians and engineers for positions in remanufacturing already. Such a move by an OEM could obviously create a squeeze for independent third-party reman outfits. Long-term business planning requires remanufacturers to consider what the future holds – and van Batenburg himself will be giving his thoughts on new reman technologies for hybrids and electric engines at ReMaTec 2017 in Amsterdam in June.

Tesla Model S: one of the biggest-selling EVs in the world

Increasing ECUs

However, EVs are only the most eye-catching manifestation of the rise of electronics in the automotive industry. ECUs have been increasing in number of the last couple of decades, controlling the most basic engine functions from fuel injection onwards. Persistence Market Research’s new report Europe Market Study on Automotive Parts Remanufacturing highlights this trend. “Emergence of new products and components for controlling a vehicle's performance serve as an underlining driver for the growth in the remanufacture of automotive parts in Europe,” it says. “Advent of hybrid and advanced vehicles in Europe is also favouring the adoption of automotive parts remanufacturing.

Core components are getting remodelled through remanufacturers, and are being augmented with the latest hi-tech devices.” This is a positive view and these parts do need remanufacture, of course – but FIRM president Clemens Ortgies sees challenges as vehicles become more complex: the typical reman company is a small- or medium-size business, so may not be able to invest huge amounts in training and new technology to handle the reman of electronics. He suggests that more co-operation between companies may be the answer. Yes, there are issues for reman, agrees Fernand Weiland, former chairman of APRA Europe and author of Make New Again. But he argues that the remanufacturer who does embrace electronics technology “can easily differentiate himself from his competitors”.

Rheinmetall Automotive CEO Horst Binnig has commented that drive system electrification alone takes in so many factors that it is impossible for a single auto manufacturer - or supplier for that matter - to handle them alone, not least because there are still so many uncertainties about where the technology will take us. “If I take a look at the products we currently supply for the purpose of optimising the drive train on an internal combustion engine and compare these with what we currently have in our development pipeline for future types of drive systems, I arrive at a substantial growth in value,” Binnig says. “In terms of figures, this could be almost double our share of sales per unit. As early as 2020, electrification will account for over one half of our sales.”

Future opportunities

The company is even now working on castings for the battery holders of EVs and on cooled aluminium housings for the electric drive units themselves. It is no surprise that Binnig is excited about the future. “It will help our industry move forward if we are able to master the challenges ahead,” he concludes. “Completely new opportunities will open up of which we have no notion now.” This is appealing. But for many remanufacturers, it is still going to take a lot of unlearning to move away from the ‘infernal’ combustion engine (as some environmental activists call it) onto completely new technology such as EVs. For some, the change will simply be too much – and at the moment, electric motors in cars simply do not need remanufacturing, suggests van Batenburg: “But eventually something will go wrong, something will wear out. We’re the old blacksmiths. We used to shoe horses and fix carriages.” He laughs but has a serious point: there is not much demand for blacksmiths’ services any more. And specialists in automotive reman need to be careful that they do not go the same way.

Although the amiable van Batenburg seems pessimistic, he offers some hope for remanufacturers who might feel overwhelmed by the rise of new technology. “Reman skills are so transferable – electric cars are just things we’ve had for a long time, but now all put together.” Yet the technology is moving quickly and no-one yet knows what will ensure reman’s survival in this brave new world. For now it seems likely that EVs will require remanufacture less frequently than existing models. For automotive reman, therefore, diversification is probably going to be crucial – but one thing’s for sure: now is the time to think about it.

Biggest-selling electric cars in the world

1 Nissan Leaf

2 Tesla Model S

3 Build Your Dreams (BYD) Tang SUV

4 BYD Qin

5 Chevrolet Volt