The European Union’s automotive market has entered 2025 with signs of cautious adjustment. According to the latest figures, new passenger car registrations in the EU declined by 1.9% during the first quarter of 2025 compared to the same period in 2024. This slight contraction reflects ongoing market headwinds, including economic uncertainty and evolving consumer preferences. Beneath the surface, however, the data shows a profound transformation: battery-electric vehicles (BEVs) continue to expand their foothold, while petrol-powered cars experience a sharp and widespread decline.

Overall market performance, a mild contraction amidst transformation

The 1.9% dip in total car registrations highlights a market still grappling with broader challenges. Although the scale of the decline is modest compared to previous pandemic-affected years, it underscores a lingering hesitation among consumers. Inflationary pressures, high interest rates, and uncertainty around future regulations are all influencing purchasing decisions. Furthermore, many consumers remain cautious amid broader economic volatility, leading to delays or reconsiderations of big-ticket purchases such as new vehicles.

At the same time, this overall decline masks important structural shifts taking place within the industry. Electrification is no longer a peripheral trend but a mainstream movement, steadily changing the composition of Europe's new car fleet.

Petrol cars, a significant decline across major markets

One of the most striking developments in Q1 2025 was the dramatic decline in new petrol car registrations. Across the EU, petrol-powered vehicle sales dropped by a substantial 20.6% year-on-year. This sharp fall affected all of the bloc’s key automotive markets, including Germany, France, Italy, Spain, and others. The reasons for the petrol slump are multifaceted. Firstly, regulatory pressure is steadily mounting. With the EU's target to phase out the sale of new internal combustion engine (ICE) vehicles by 2035, manufacturers and consumers alike are adapting to the reality that petrol cars represent a technology of the past. Secondly, many national governments continue to reduce or eliminate incentives for traditional ICE vehicles, while simultaneously offering subsidies for electric alternatives. Finally, a growing number of urban areas are implementing low-emission zones, effectively discouraging the use of petrol and diesel vehicles in favour of cleaner alternatives. This broad and consistent decline across all major markets highlights a profound shift in consumer behaviour. Petrol cars, once the mainstay of the European automotive landscape, are steadily losing relevance in an increasingly electrified environment.

Battery-Electric Vehicles, a growing share of the market

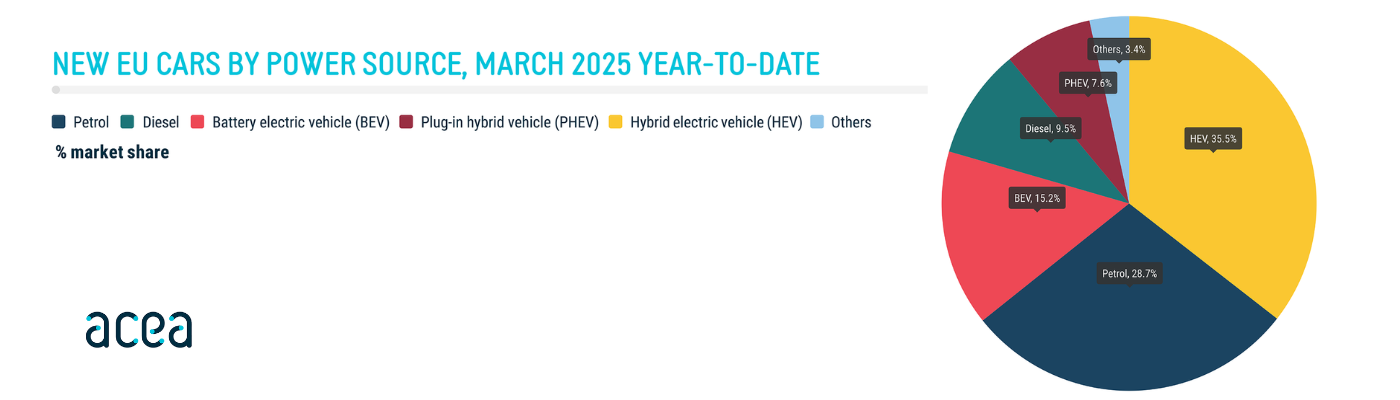

In contrast to the downturn in petrol vehicle sales, battery-electric vehicles (BEVs) continue to rise in popularity. In Q1 2025, BEVs achieved a 15.2% market share in the EU — a notable year-on-year increase that solidifies their role in the mainstream automotive sector.

Several factors are contributing to the growing acceptance of BEVs. The expansion of the public charging network across Europe has alleviated one of the primary concerns for potential EV buyers: range anxiety. At the same time, improvements in battery technology have led to longer driving ranges and shorter charging times, making EVs a more practical option for a wider range of consumers. Manufacturers are also playing a crucial role. Most major brands now offer a broad array of electric models across various price points and segments, from compact city cars to premium SUVs. The increased competition has driven technological innovation and helped bring down costs, making BEVs more accessible to the average consumer. In addition, environmental awareness continues to rise among European citizens, and many consumers are choosing electric vehicles not only for economic reasons but also as a statement of personal values regarding sustainability and climate change. Countries such as the Netherlands, Sweden, and Denmark continue to lead the adoption of BEVs, thanks to strong government incentives, well-developed charging infrastructure, and supportive policy frameworks. Meanwhile, southern and eastern European countries, although lagging behind, are showing steady improvement as infrastructure investment and consumer interest increase.

Hybrid Vehicles and Other Trends

While BEVs are gaining momentum, hybrid vehicles — including both full hybrids and mild hybrids — are also carving out a significant space in the market. Hybrids offer a transitional technology for consumers who are not yet ready to switch to fully electric cars but are seeking improved fuel efficiency and lower emissions compared to traditional petrol or diesel vehicles.

Nevertheless, the growth of hybrids was not sufficient to compensate for the substantial decline in petrol sales during the first quarter of 2025. Diesel vehicles, for their part, continue to slide, further consolidating their long-term decline, exacerbated by past scandals and increasingly strict emissions standards.

Challenges Ahead for the Automotive Industry

Despite the positive momentum for BEVs, the EU car market faces significant challenges as it navigates 2025. Affordability remains a key issue: although the cost of EVs has fallen, they still typically carry a higher upfront price compared to ICE vehicles, posing a barrier to widespread adoption, especially in lower-income regions.

Macroeconomic conditions also play a crucial role. Persistent inflation, elevated interest rates, and potential economic slowdown in key markets could dampen consumer confidence and spending power. Additionally, while charging infrastructure is expanding rapidly, disparities still exist between urban and rural areas, and between different member states.

Manufacturers must also contend with supply chain complexities, particularly concerning critical materials for battery production, such as lithium, cobalt, and nickel. Ensuring a stable, ethical, and sustainable supply of these materials will be crucial to supporting the future growth of BEV sales.

Looking Forward

As 2025 unfolds, the European automotive sector stands at a pivotal crossroads. The modest overall decline in car registrations during the first quarter masks the profound and accelerating transformation within the industry. The sharp fall in petrol car sales, coupled with the rapid rise in BEV market share, signals that Europe's transition to electric mobility is well underway.

Future growth will depend heavily on continued government support, infrastructure expansion, technological innovation, and the ability of manufacturers to offer attractive, affordable electric vehicles that meet the diverse needs of European consumers.

The first quarter of 2025 offers a clear message: while economic headwinds persist, the direction of travel for the European car market is unmistakably electric.

Share your remanufacturing stories with us

Do you have an innovation, research results or an other interesting topic you would like to share with the remanufacturing industry? The Rematec website and social media channels are a great platform to showcase your stories!

Please contact our Brand Marketing Manager.

Are you an Rematec exhibitor?

Make sure you add your latest press releases to your Company Profile in the Exhibitor Portal for free exposure.