OEMs and IRs (Independent Remanufacturers): a winning cooperation

For OEMs who do not have remanufacturing capabilities but wish to benefit from the remanufacturing business, authorisation is a frequent option. There are primarily two authorisation strategies to consider: the first is dealer authorisation, whereby the OEM converts the independent remanufacturer (IR) into an authorised dealer selling both new and remanufactured products; the second is remanufacturing authorisation, whereby the OEM grants the IR permission to remanufacture used products in exchange for a fee. To compare the three scenarios, competition, cooperation with dealer authorisation, and cooperation with remanufacturing authorisation, a stylized model is created.

A winning cooperation

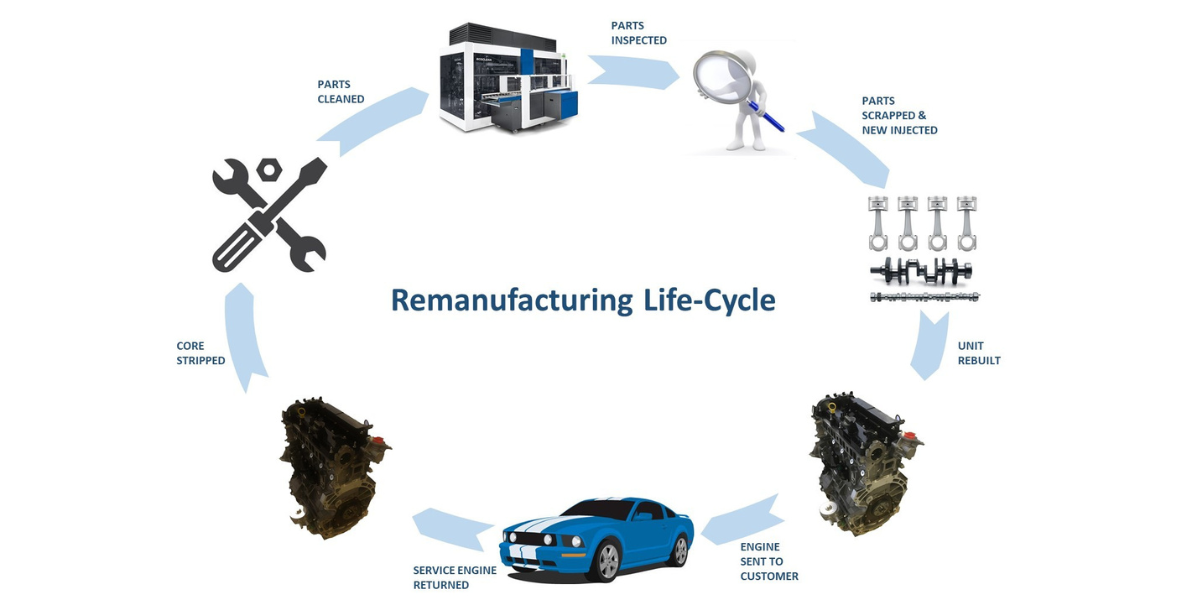

This cooperation is reliant on how better client willingness to pay for remanufactured goods is affected by authorisation. Although the OEM prefers remanufacturing authorisation, only dealer authorisation is possible. Many successful examples from the automotive components industry have shown that remanufacturing can be a very profitable business because it recovers the residual value of end-of-use products. But not all original equipment manufacturers (OEMs) can remanufacture; in fact, most OEMs buy crucial components from their suppliers. As a result, these OEMs lack the skills and/or expertise necessary to process old goods. Used products in the automotive sector may be so heavy that OEMs cannot afford to collect them. Therefore, independent remanufacturers (IRs) that have the necessary skills and are situated close to consumers, the buyers of remanufactured items, as well as the suppliers of old products, frequently carry out remanufacturing operations. OEMs and IRs view one another as rivals since remanufactured items cannibalize new products. According to traditional thinking, OEMs can prevent IR entry. A lot of OEMs employ a variety of tactics to limit IR access to end-of-use devices or to raise their operational expenses. To prevent third-party remanufacturing, several OEMs gather discarded products and recycle or dispose of them. However, even if these aggressive measures are successful in preventing remanufacturing at a cheap cost, these OEMs forfeit the chance to gain from remanufacturing.

OEMs’ tactics to take advantage of IRs’ remanufacturing

Some OEMs have recently modified their tactics and started working with IRs to promote the advantages of remanufacturing. Cooperation frequently involves authorisation. In practice, two different sorts of authorisations are seen. One is to make the IR an authorized dealer who is permitted to market both new and remanufactured goods (dealer authorisation). In other words, the IR is allowed to sell remanufactured goods as long as it also sells new goods obtained from the OEM. The OEM can reach nearer to customers and sell more new items via the IR by utilizing extensive product maintenance and servicing networks. The other is remanufacturing authorisation, which involves charging the IR for using the OEM's information and technology to remanufacture the OEM's product. This is the most typical method of remanufacturing for OEMs and is applied widely in various sectors, including the automotive industries. Through increased consumer willingness to pay (WTP) brought on by the authorisation, the IR can gain from cooperating. It is not initially obvious to either participant whether authorisation is desired over the rivalry between the OEM and the unauthorised IR because cooperation necessitates the involvement of both players to achieve a win-win situation. Both must compromise between the advantages of authorisation and the expense. For instance, the OEM must determine if the higher cannibalization between new and remanufactured products is balanced by the additional cash from sharing remanufacturing benefits with the IR. Like this, the IR weighs the prospective effects of selling the new items as well (under dealer authorisation) or paying the authorisation fee against the enhanced valuation for its remanufactured products (under remanufacturing authorisation).

Even if OEM and IR are both adamant about working together, it remains to be seen whether they will concur on the same authorisation. The IR may want dealer authorisation since selling new items may produce new revenue, whereas the OEM may prefer remanufacturing authorisation as the authorisation charge is an additional cash source. Additionally, it is unclear how cooperation would affect customers and the environment. Remanufacturing may result in a sales growth impact, which from an environmental perspective could lead to an increase in overall resource consumption. This advantage may be diminished or lost if cooperation increases product cannibalization between new and remanufactured goods. Although price increases for remanufactured products brought on by authorisation may reduce consumer surplus, cannibalization between new and remanufactured products may also be advantageous for customers.

Three conclusions to take into account

Therefore, there are three possible conclusions to consider: no cooperation, in which the IR remanufactures without authorisation and sells products that are in direct competition with the OEM's new product; dealer authorisation, in which the OEM grants the IR permission to remanufacture by requiring her to sell both new and remanufactured products; and remanufacturing authorisation, in which the OEM grants the IR permission to remanufacture by levying. We expressly consider the improved willingness-to-pay of customers for authorized remanufactured products to calculate the possible benefits of authorisation for the IR. Cooperation is possible if the impact of authorisation is significant enough, or if consumer desire to pay for authorized remanufactured goods is great enough. Because it can control the primary market and additionally split secondary market profits with the IR through an authorisation charge, the OEM always favors remanufacturing authorisation. However, merely dealer authorisation can be accomplished when the impact of the authorisation is insufficiently significant. It's interesting to note that the OEM's profit margin may be rising along with the price of the new product. When the OEM switches to remanufacturing authorisation, that occurs. From a consumer surplus and environmental point of view, you demonstrate that cooperation will increase consumer surplus, though the results on environmental impact are more conflicting. Nevertheless, cooperation may improve the triple bottom line by providing economic benefits to the OEM and IR as well as increasing consumer surplus while also lowering resource consumption.

Cooperation may improve or decrease the sales of remanufactured products by increasing customers' willingness to pay for them. As a result, businesses can utilize increasing consumer perception of the product's attractiveness to contract supply and reap further profits. Many OEMs believe that third-party remanufacturers pose a competitive threat that needs to be eliminated because they are unable to profitably remanufacture end-of-use products on their own. But as competition in the main market increases, OEMs start to consider the advantages of remanufacturing by working with independent remanufacturers.

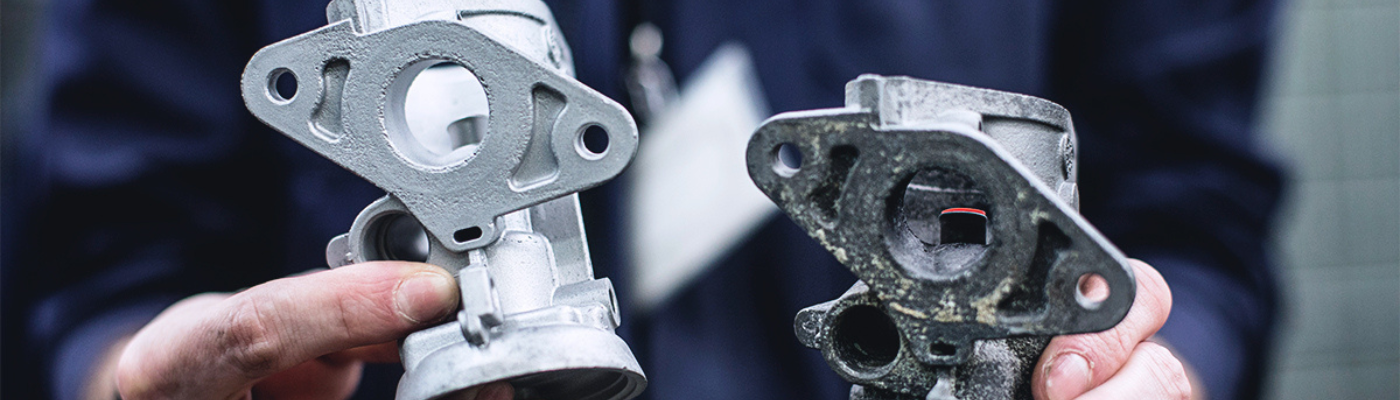

Photo credits: BORG Automotive