Who's afraid of the Chinese dragon?

It all started with an interview with the CEO of Stellantis, the Portuguese Carlos Tavares, on the last Paris Motor Show in October 2022. Regarding the diffusion of electric cars, according to Tavares - "Europe must be protected from the invasion of the Chinese car market, which could be harmful to the economy of the Old Continent."

Cry of alarm

China’s technological and marketing advantages, today more than ever, over the US and Europe, allow China greater market penetration over its competitors. The monopoly of raw materials, domestic market strength, high technological level, government incentives, and a design of vehicles that have gone from decidedly unattractive lines to those of today futuristic and that have nothing to envy with the design of Western cars. These are the values that put China at an advantage over its competitors in anticipation of an imminent invasion of the European market.

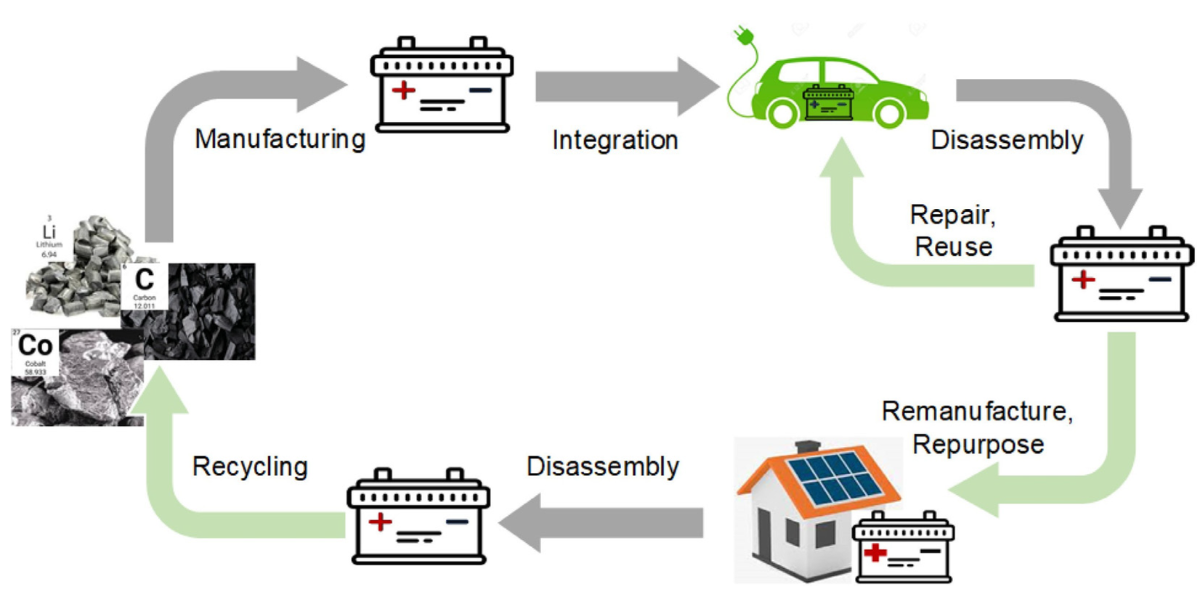

Car manufacturers, OEMs, and start-ups from China are in a prime position to achieve this goal. If it is true that the widespread of BEVs in Europe is now consolidated, the prices for their purchase are 30% higher than in China. The danger, therefore, is that China, on the strength of this, could reach a predominant position in Europe to create significant imbalances within the industrial, social, and employment framework in the automotive sector. For some years now, pushing BEVs has meant opening the doors of the European market to Chinese products in general (electric and hybrid vehicles, but also batteries and components) which are also facilitated by more advantageous taxation compared to what European companies are forced to face to sell their products in China.

According to data from 27 countries, as much as 20% of all battery-powered cars registered in August were produced in China, the second largest country of origin after Germany, which reached 28%. South Korea (8%), the Czech Republic and France (7%), Spain (6%), the United Kingdom (5%), Italy (4%) and other countries (14%) follow. In August, registrations of “made in China” BEVs grew by 78%, compared to 17% of those assembled in the Old Continent.” (Jato Dynamics)

Interestingly, the Chinese are buying EVC because it's cheaper and easier to get a car license than ICV while Europeans are buying it more because it's eco-friendly. Most of the Chinese EVCs are getting money from the capital but not market and consumers.

We need reciprocity

According to Carlos Tavares, “We need reciprocity, there is no reason to make it easy to access the Old Continent without having the same in exchange. Chinese manufacturers "are welcome in Europe" only if those from the Old Continent can access China under the same conditions. Brussels does not realize the risk of losing the entire continental automotive industry, customs barriers must be introduced to protect Western manufacturers, at least for ten years. We should follow the example of the United States, which has constrained the provision of North American incentives for production and raw materials. Once the transition is complete, the limits may gradually disappear.”

Low prices, BEVs for all

Due to their high prices, the BEVs will mostly be the prerogative of wealthy customers, thus reducing the presence of low/middle-class customers from this market and increasing the risk of not reaching significant sales volumes which instead would be necessary for a consistent reduction of polluting emissions into the environment. “Today the privileged who have the means, a garage and a socket for home charging point can afford an electric vehicle”, underlines Luca De Meo, CEO of Renault. So, a dangerous window would open for the BEVs manufactured in China (only 18% belonging to Chinese brands, the rest to Western brands, first of all Tesla), which would thus satisfy those customers today in difficulty in purchasing Western production models due to their still high cost! This is another advantage of electric vehicles of Chinese origin.

If the invasion is therefore inexorable, the European automotive industry will face a very serious and difficult challenge. It is necessary to limit and optimize the rise of Chinese BEVs, while at the same time making the offer of the European industry more competitive. As mentioned, several times, the steps to make a feasible ecological transition must be carefully evaluated protecting the workforce in the ICVs - BEVS transition and taking seriously attention to all the other forms of alternative fuels (LPG, CNG, Hydrogen), which have a lot to say. The European Parliament, therefore, instead of setting the ban on internal combustion engines in an ideological way, should seriously ask itself whether European car manufacturers are ready to face and win the electric challenge. For the goal of not selling combustion cars from 2035, the point of view of many remanufactures is that it represents a goal to idealists. The European government, we can be sure, must release regulations to protect local car manufacturers.