CLEPA's Thorsten Muschal: Optimism and caution prevail, entering into 2021

The automotive and mobility technology suppliers have started the year 2021 with mixed feelings of optimism and caution. Optimism, because demand for vehicles and components is picking up more rapidly than expected and the appetite for new, innovative technologies is accelerating. Caution, because the scars from 2020 are deep and the level of uncertainty remains high.

What are the threats and opportunities for the automotive and mobility technology sector in 2021? We’ve listed five themes that will play a key role in shaping the recovery.

Thorsten Muschal, member of the management of Faurecia and CLEPA President comments on the supply industry’s outlook on the new year: “COVID-19 has hit the automotive supply industry particularly hard and the impact of the crisis will remain a major factor in the new year. Many in the supply industry, in the last months of 2020, have managed to recover a good portion of the earlier revenue losses, allowing for optimism as regards further recovery in 2021. However, uncertainty remains high given the volatility associated with the containment of the COVID-19 pandemic.

Until large parts of the population have been vaccinated, the threat keeps looming of supply chain disruptions, factory lockdowns and border closures which caused much damage during the first wave of the pandemic. As a consequence, the planning of production remains much more challenging than it usually already is in the just-in-time operations of the sector.

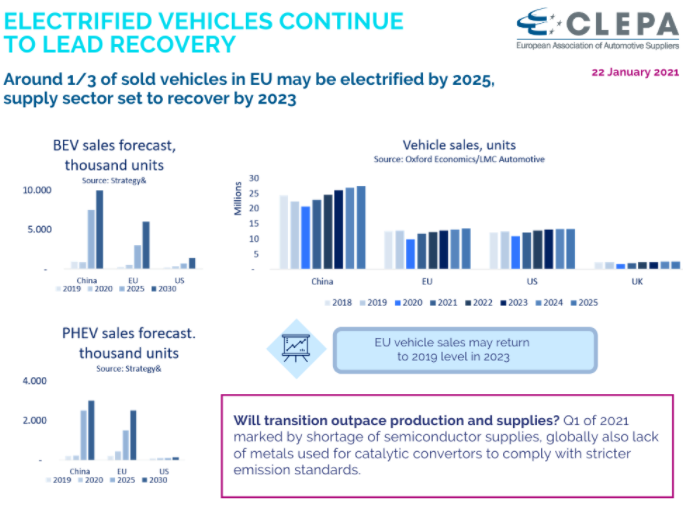

An illustration of this is provided by the current shortage of semi-conductors in the automotive sector. A combination of different factors – the COVID pandemic, the trade war between China and the US, a spike in demand from the consumer electronics side and the acceleration of vehicle electrification – has added weeks of delay to already long supply chains.

This has fortified questions on the need for ‘strategic autonomy’ of the EU and localisation of supply which need to be carefully assessed in the context of global playing fields and competitiveness. The global trade environment will in any case continue being an important factor for stability.

In 2021, the risk of further employment loss remains high. Last year, over 50 thousand job cuts were announced by Tier1 suppliers alone, according to Eurofound data, matching a similar number with vehicle manufacturers. The situation among small and mid-sized enterprises is more difficult to account for but, as a rule of thumb, one job with Tier1 suppliers generally supports another two to three livelihoods down the supply chain. Smaller companies also tend to have more trouble keeping up liquidity to sustain their business.

A further major concern is presented by the cuts that many suppliers had to make in their R&D budgets in order to cope with the crisis. R&I is the main factor in ensuring that automotive products are continually improved in terms of environmental impact and social sustainability. European suppliers are at the forefront when it comes to making vehicles continuously more sustainable, smart and safe with the help of advanced powertrain solutions, connectivity and automation. Substantial R&I investments are crucial for the development of affordable mobility. Particularly in today’s time of rapid change, with the unfolding transition to a green and digital societal, the impact cannot be underestimated, and is essential for the competitiveness for our industry.

2021 will be an extremely dense year from an EU policy perspective. We expect regulatory proposals on crucial topics such as CO2 emissions, Euro 7, data use and access, artificial intelligence, and the organisation of the aftermarket. Sustainability criteria and circular economy requirements will continue to fuel policy debate as well.

For businesses and policy makers, a major challenge will be to manage the transition in an inclusive and competitive fashion. Our primary objective, as industry, is to transform the mobility of tomorrow, to up- and re-skill our workforce and to keep R&D highest on our priority lists. As part of the implementation of a renewed European industrial strategy, it will be crucial to analyse the specific needs of industrial ecosystems such as ours, to tailor political support and measure impact on competitiveness and employment—all of course within the broad policy agenda of the EU Green Deal and digital transition.

The year 2020 has been one like no other. Working together has been instrumental to cope with the many challenges and this will be no different in 2021. The COVID crisis has shown the value of standing strong, together. In this spirit, we look forward to working with our customers, stakeholders and policy makers again also in 2021, advancing sustainable mobility and a competitive industry in Europe.”

Thorsten Muschal is Executive Vice President of Sales and Program Management at Faurecia, and CLEPA President since 2020.

.png?h=600&iar=0&w=1200)