Solid-state battery, a dream solution

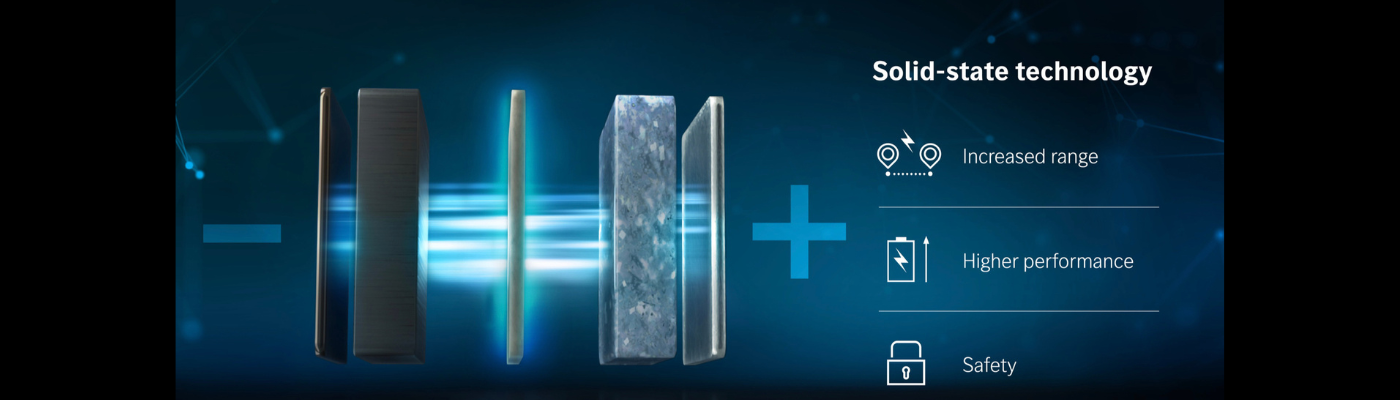

Solid-state batteries are widely viewed as the next big breakthrough in energy storage for battery electric vehicles (BEVs), potentially transforming automotive design, performance, safety, and sustainability. Unlike conventional lithium-ion batteries, which use a liquid electrolyte to transport lithium ions between the anode and cathode, solid-state cells incorporate a solid electrolyte material—typically based on ceramic oxides, sulphides, glasses, or polymers. This change may appear incremental, but it has substantial implications for energy density, charging time, mechanical packaging, cost structures, and overall vehicle attractiveness.

Solid-state batteries, pro and cons

Lithium metal as the “dream solution”

One of the most compelling advantages of solid-state technology is the possibility of replacing the graphite anode used in today’s lithium-ion cells with metallic lithium. Lithium metal is regarded as the “dream solution” anode for batteries due to its extremely high theoretical capacity and low weight, meaning more energy can be stored in a smaller, lighter battery pack. With a solid electrolyte suppressing dendrite growth—sharp lithium filaments that can short-circuit batteries—these latest batteries could deliver 70% to 100% more energy density compared to today’s lithium-ion cells. This increase in specific energy would allow BEVs to travel 700–1000 km on a single charge without increasing the battery footprint, easing range anxiety for consumers and enabling smaller, lighter vehicles with enhanced efficiency.

Safety is another major promise. Liquid electrolytes are typically flammable and volatile, raising the risk of fire in the case of damage, overheating, or manufacturing flaw. By removing these flammable components, solid-state batteries are inherently safer in abuse conditions such as high-temperature operation, puncture or crush events. This would enable automakers to reduce the heavy metal shielding and cooling systems currently required in battery packs, saving weight and cost while providing peace of mind to customers and emergency responders. These safety benefits could be transformational for vehicle architectures, accelerating the adoption of battery-as-a-structure concepts and packaging batteries in areas currently off-limits due to crash-safety rules.

Fast charging

Fast charging, a frequent customer pain point in today’s BEVs, is also expected to improve under solid-state designs. Certain ceramic and sulphide solid-electrolyte materials have very high ionic conductivity—allowing lithium ions to move quickly through the battery—even at lower temperatures. This could enable batteries that charge from 10%-80% in under 15 minutes, matching or surpassing the refuelling time of combustion-engine vehicles. In practice, the speed of charging will depend on the stability of electrode-electrolyte interfaces and the heat-management system of the pack, but the fundamental materials science supports unprecedented performance. Consumers accustomed to quick petrol stops could therefore transition to electric driving with minimal behavioural adaptation.

Durability and sustainability

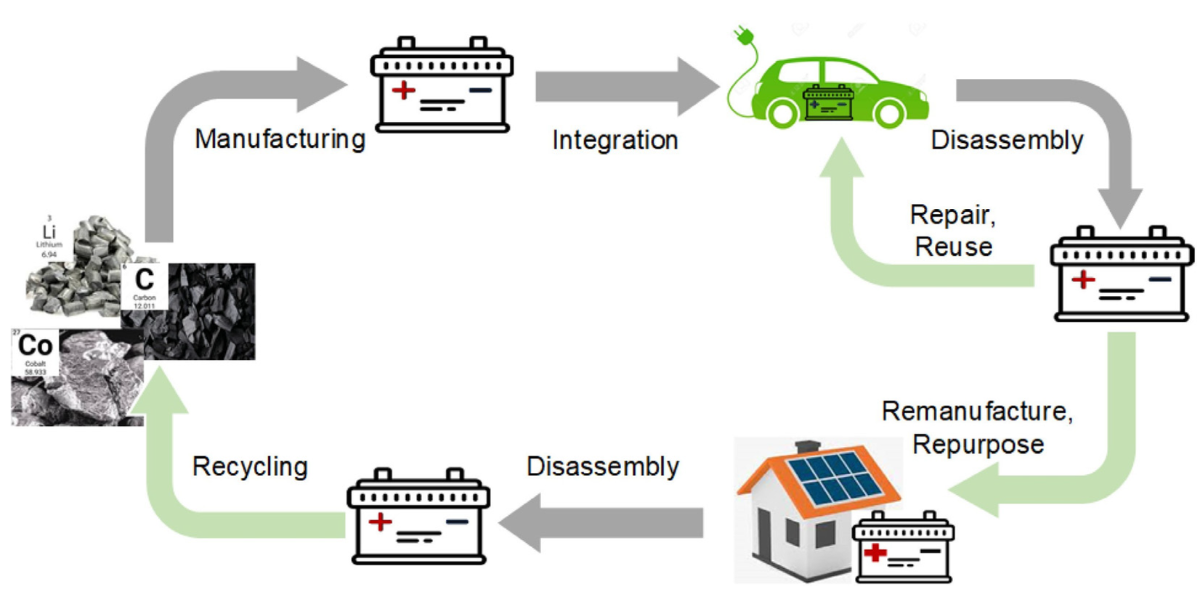

In addition to performance, solid-state batteries hold long-term advantages in durability and sustainability. Current lithium-ion batteries fade gradually because liquid electrolytes react with electrodes during charge/discharge processes, forming new layers and consuming lithium ions, a process that increases internal resistance and reduces energy capacity over time. Solid electrolytes are more chemically stable, limiting these side reactions and significantly extending battery cycle life. Longer lasting batteries mean better total cost of ownership, fewer replacements, and increased feasibility of second-life applications such as stationary energy-storage systems. Furthermore, higher energy density means fewer raw materials are needed to store the same amount of energy, helping to reduce global mining pressure, especially on critical minerals like nickel and cobalt.

An engineering and manufacturing challenge is needed

Despite the advantages, solid-state automotive batteries face substantial engineering and manufacturing challenges. The first is materials selection: solid electrolytes must exhibit high ionic conductivity, wide electrochemical stability, minimal reactivity with electrodes, and suitable mechanical properties to maintain contact during charge/discharge. Ceramic electrolytes generally offer good conductivity and stability but are brittle, prone to cracking and difficult to process into large, thin layers needed for high-energy cells. Sulphide-based electrolytes are softer and easier to form but react violently with moisture, releasing toxic hydrogen sulphide gas, necessitating strict environmental controls in manufacturing. Polymer electrolytes, conversely, are more pliable and easier to scale but often conduct ions only at elevated temperatures, limiting room-temperature performance unless heavily engineered composites are used.

The second major challenge is interfacial resistance. When a solid electrolyte is placed against a solid electrode, microscopic gaps or roughness between the surfaces impede ion flow. Liquids easily wet and infiltrate electrodes to ensure good contact, but solids do not. Creating intimate, stable interfaces often requires high-pressure stacking, specialized coatings, or novel processing such as sintering, all of which add manufacturing complexity and cost. These interfaces must also remain intact over repeated charging cycles, resisting delamination or void formation as electrodes expand and contract. To date, most solid-state prototypes that demonstrate high energy density have done so in laboratory settings using small cell formats or thin-film layers, which are relatively easy to fabricate. Scaling these architectures into large-format pouch or prismatic cells used in vehicles—while retaining performance, reliability, and affordability—is proving immensely difficult.

Costs

Cost is perhaps the most main barrier. Today, in 2025 lithium battery price for electric vehicle (EV) typically range from $4,760 to $19,200 per pack, depending on size and manufacturer. For example, a 48V 200Ah lithium battery (around 9.6kWh) is priced between $2,227 and $11,000, reflecting significant variation across specifications and suppliers. In contrast, solid-state cells presently cost several hundred dollars per kilowatt-hour due to expensive materials, low manufacturing volumes, and complex process requirements. To compete economically, solid-state manufacturers are aggressively developing scalable production techniques such as roll-to-roll coating, dry-room assembly, co-sintering of electrode-electrolyte layers, and integrating solid-electrolyte production into existing lithium-ion giga factories to reduce capital expenditures. Some companies, therefore, are focusing first on hybrid “semi-solid” designs that replace only part of the liquid electrolyte, trading off some performance gains for manufacturability and cost reductions. These hybrid cells are likely to appear in vehicles before full solid-state systems.

Automotive companies are acutely aware of both the potential and the hurdles. Toyota has been developing solid-state batteries for more than a decade and aims to introduce them by the late 2020s, initially in hybrid vehicles before full BEV use. Volkswagen, through its partner QuantumScape, is pursuing ceramic oxide solid-state chemistry, with plans for commercial deployment after 2026 if performance and longevity meet standards. Ford, BMW and Mercedes are aligned with Solid Power, a U.S. start-up working on sulphide-based electrolytes and multilayer scalable cell formats. CATL, Samsung SDI and Panasonic are also investing in R&D, with Chinese manufacturers particularly keen to domesticate supply chains as global demand for BEVs rises sharply. Most experts believe limited volumes of solid-state batteries will hit the BEV market by around 2028, likely in premium or high-performance models where consumers are willing to pay extra for extended range and fast charging. Gradual cost reduction and process optimisation could then see wider adoption in the early to mid-2030s.