Battery remanufacturing, the current scenario – part one

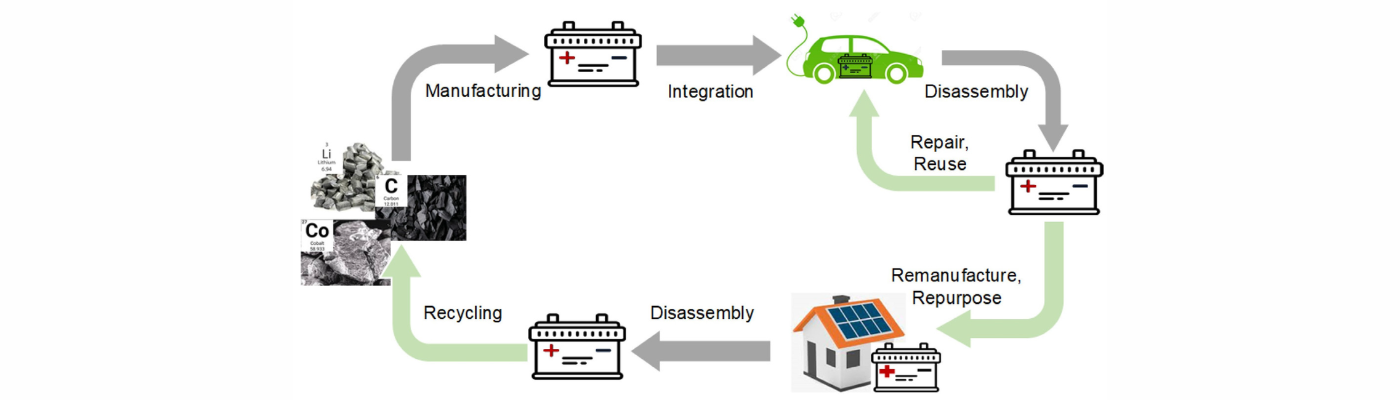

Battery remanufacturing — the industrial process of returning used battery packs, modules, or cells to a like-new condition so they can renter vehicle use or be redeployed in other applications — sits at the intersection of economics, safety, regulation, and circularity. It promises substantial environmental benefits and cost savings but also confronts substantial technical, logistical, and market hurdles. The current landscape is therefore one of active pilots and scaled demonstrations, growing regulatory pressure, significant private investment, and cautious but accelerating commercial rollouts.

Simple arithmetic

One of the central economic drivers for battery remanufacturing is simple arithmetic: batteries are expensive, they contain concentrations of critical minerals, and battery manufacturing is capital-intensive. Global battery manufacturing capacity expanded dramatically over recent years and remains big enough that supply dynamics—production scale, geographic concentration, and cost trajectories—shape the viability of remanufacturing strategies. Large cell production growth has driven down per-kWh costs and created a degree of overcapacity in some regions, which affects the relative price gap between new and remanufactured packs; nevertheless, the embedded value of remaining cell capacity and critical metals keeps remanufacturing attractive for many use cases, particularly for fleets and applications where cost sensitivity is acute. The rapid scale-up of battery production (with global cell manufacturing capacity growing significantly in 2024) changes the calculus in two ways: it lowers replacement cost for brand-new packs while at the same time enlarging the eventual return stream of used cores that remanufacturers will need to process.

Quality and know-how

Practical remanufacturing is already visible in several markets. Small and medium enterprises alongside OEM initiatives are proving that packs can be partially rebuilt, modules and cells replaced, and balance-of-plant hardware reconditioned so that the overall pack performs close to its original specification for many more miles. In South Korea, for example, companies have built commercial processes that disassemble packs, isolate failing cells, replace them, and recondition the pack to sell as a lower-cost alternative to new units; these operations claim significant salvage rates and large discounts versus new packs. Such business models reveal important lessons: high-quality testing protocols, robust safety practices, and clear performance warranties are non-negotiable if remanufactured batteries are to win market acceptance.

EU Battery Regulation and Digital Battery Passport

EU policy, meanwhile, is driving a transparency revolution that directly supports remanufacturing. The new EU Batteries Regulation and the digital battery passport concept require lifecycle tracking, chemistry disclosure, and traceability of manufacture and use data. This kind of digital provenance reduces uncertainty about a pack’s origin and service history, enabling remanufacturers to make more reliable judgments about which packs are suitable for refurbishment for vehicle use and which should instead be repurposed or recycled. The regulation also mandates higher recycling efficiencies and recovery targets for critical minerals, creating policy incentives to extract maximum value from a battery before it is broken down. For remanufacturers operating in or exporting to the EU, these regulatory changes both raise compliance requirements and enlarge market opportunities by improving data availability and thus reducing core uncertainty.

Inside the battery remanufacturing work

From a technical viewpoint, battery remanufacturing exists on a spectrum. On one end lies light remediation — testing a returned pack, replacing a handful of failed cells or control electronics, and returning the unit to service — while on the other lies full cell-level refurbishment and rebuild, which requires cell sorting, cell balancing, and in many cases, re-welding or re-assembling modules. The finer the granularity of disassembly (cell versus module versus pack), the more value potentially recoverable, but also the greater the capital, tooling and safety complexity. Non-destructive evaluation techniques, advanced diagnostics, and automated testing rigs are therefore critical to achieving good yields. Machine learning applied to charge-discharge histories and in-field telematics is rapidly becoming a core capability: by analysing usage profiles, temperature histories and voltage degradation patterns, remanufacturers can make better predictions about remaining useful life and select the appropriate remediation pathway. This diagnostics layer is what turns raw cores into bankable inventory rather than risky liabilities. Design plays an outsized role in how feasible remanufacturing will be at scale. Many early-generation battery packs were constructed for maximum energy density and minimum cost, not for serviceability. Glue, potting, bespoke cooling channels, and sealed modules complicate safe disassembly. However, as regulators and OEMs recognize the importance of circularity, a growing cohort of newer packs incorporate modularity, standardized connections, and mechanical fastenings that simplify removal and repair.

Circular economy and automotive players

Automotive players with explicit circular-economy strategies — including OEM remanufacturing centres and refectories — are showing how design choices influence end-of-life options: modular packs and replaceable cells massively reduce the per-unit cost of remanufacturing and increase yields. Some automakers’ circular facilities, for instance, have publicly described programs for repairing and remanufacturing batteries as part of broader efforts to extend component life and integrate second-life uses. Collection and core management remain among the thorniest operational bottlenecks. Remanufacturing requires a well-functioning reverse logistics network: secure collection, safe transport, triage and intermediate storage, and sorting by chemistry and condition. Batteries present hazards — thermal runaway risk, high voltage, and chemical instability — so storage and transport must comply with stringent regulations that vary across jurisdictions. Moreover, the timing and location of returns are stochastic; vehicles retire or are involved in accidents in patterns that rarely match the geographic footprint of remanufacturing plants. As a result, many firms are experimenting with distributed remanufacturing hubs, bonded zones for cross-border flows, and partnerships with dealerships, dismantlers and fleet operators to secure cores reliably. Market structure and business models are diversifying. Fleet operators and mobility services are prime early customers for remanufactured batteries: their vehicles often follow predictable usage patterns and are centrally maintained, which makes battery monitoring and core retrieval easier. For individual consumers, manufacturers’ warranties and perceptions of reliability remain decisive.