Core Challenges

The next seven years should be good for remanufacturers as the global vehicle population continues to age and there remains to be a 30% to 35% differential between the cost of new products and remanufactured ones.

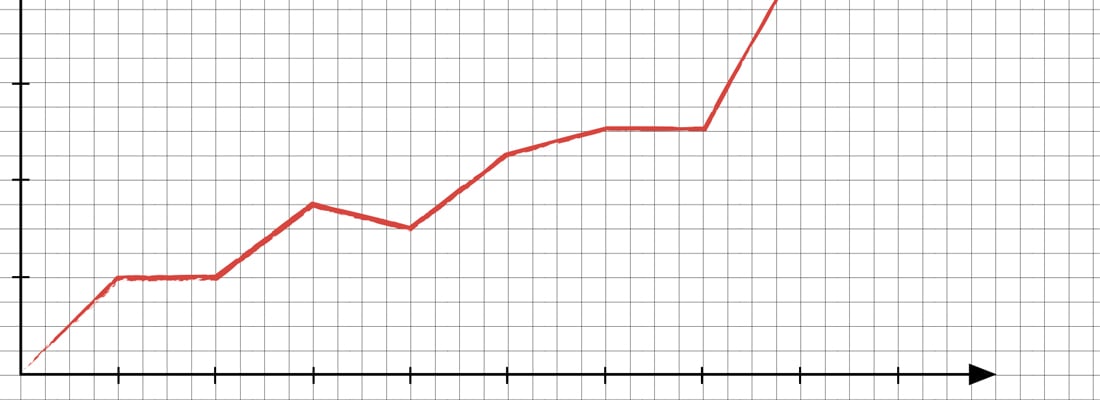

During a presentation titled Market Outlook: Understanding the Future Demand for Remanufactured Parts, Joe Kripli, president of the Automotive Parts Remanufacturers Association, shared insights from American consultancy firm, Frost & Sullivan on the future of remanufacturing. The US is expected to lose reman market share as countries like China step up their remanufacturing operations - in fact, the Chinese remanufacturing market is expected to double between 2015 and 2022.

The increased use of electronic components is becoming prominent in vehicles across the globe and will be a growth area for remanufacturers. And while the growth in global remanufacturing looks good, there will continue to be challenges with logistics, cores and legislation. Not all markets are free of trade restrictions and unless those restrictions are overcome, remanufacturing could suffer in certain parts of the world.

Share your remanufacturing stories with us

Do you have an innovation, research results or an other interesting topic you would like to share with the remanufacturing industry? The Rematec website and social media channels are a great platform to showcase your stories!

Please contact our Brand Marketing Manager.

Are you an Rematec exhibitor?

Make sure you add your latest press releases to your Company Profile in the Exhibitor Portal for free exposure.