Battery remanufacturing, the current scenario – part two

o"Second-life" market

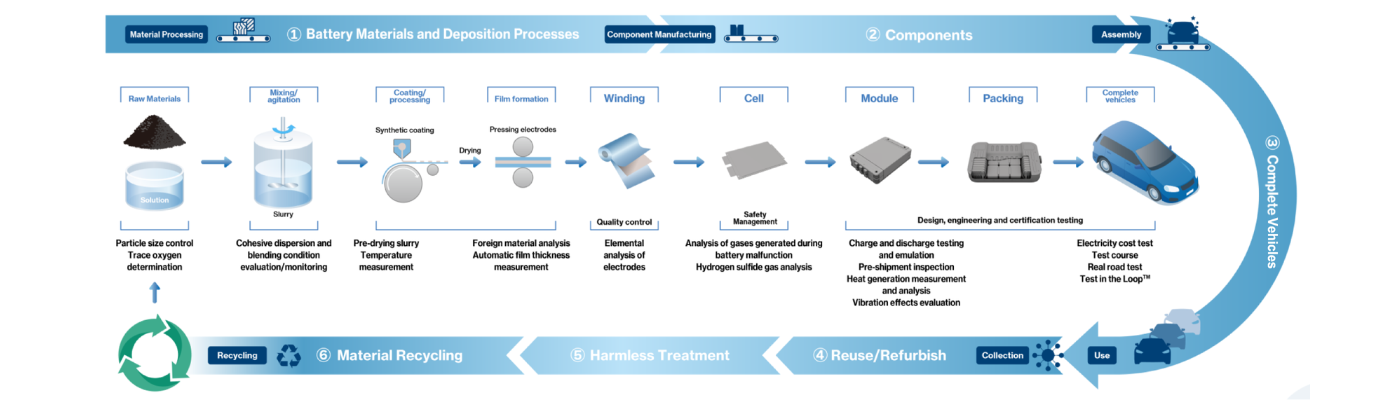

OEMs that offer battery leasing or battery-as-a-service models de-couple ownership and maintenance from the vehicle, which in turn aligns incentives: a leasing operator will typically invest more in diagnosing, repairing and returning a pack to service because the residual value is theirs to capture. In addition, the “second-life” market — repurposing automotive batteries for stationary storage, grid balancing, or backup power — provides an intermediate pathway when a pack’s remaining capacity no longer meets vehicle performance standards but still has value in less demanding, stationary contexts. This multi-stage approach (vehicle → remanufacture/repair → second life → recycling) improves resource efficiency and overall value extraction.

The importance of warranty

Quality assurance, warranties, and certification frameworks will determine how widely remanufacturing can scale into consumer markets. Remanufactured batteries must be tested against clear performance and safety benchmarks and often must be accompanied by warranties comparable to new parts, at least for commercial customers. The interplay of liability, insurance and aftermarket regulation creates complexity: a poorly tested remanufactured pack that fails and causes damage could create legal and reputational backlash that sets the industry back. Thus, independent testing labs, third-party certifications and robust data trails through battery passports are becoming foundational elements for trust.

Economics are dynamic and regional

In regions where new battery prices remain high relative to labour and refurbishment costs, remanufacturing is naturally more attractive. Conversely, where cell production has scaled massively and raw material prices drop, the relative margin for remanufacturing narrows. That said, remanufacturing delivers non-price benefits — notably carbon avoidance — which may be monetized through regulatory credits, corporate sustainability commitments, or public procurement rules. Market forecasts suggest that the reuse, repurposing and recycling segment will grow rapidly over the next decade, with investment flows following demonstrated pilot successes and regulatory certainty. Several market research and forecasting firms project strong compound annual growth for battery reuse and recycling markets, reflecting both underlying battery retirements and increasing policy support.

Cutting-edge technology

Technological changes in batteries — new chemistries, solid electrolytes, or cell formats — create both opportunity and risk for remanufacturing. On the positive side, standardized pack architectures and industry convergence around certain chemistries could simplify remanufacturing over time. On the negative side, if cell technologies evolve rapidly, remanufacturing capital invested for existing formats might become stranded. This technological risk underlines why flexible, modular remanufacturing processes and strategic partnerships are crucial: firms with diversified capabilities across diagnostics, module rework, and second-life integration are better able to pivot as pack designs change.

Highly specialized technicians

Safety culture and workforce development are central and often overlooked enablers. High-voltage battery work requires specialized training, safety protocols, and equipment. The industry is thus creating new curricula, certifications and training programs for battery technicians and remanufacturing engineers. Automation and robotics reduce human exposure, but skilled technicians remain necessary for diagnostics, quality control, and system integration. Investments in people — not just in machines — will determine how quickly remanufacturing can scale while maintaining safety and quality.

The future of battery remanufacturing

Looking ahead, the evolution of battery remanufacturing will likely be shaped by a few decisive trends. First, digitalization and transparency (battery passports and telemetry) will reduce information asymmetry and improve remanufacturing yields. Second, integrated value-chain players — those able to collect cores, remanufacture, repurpose, and finally recycle — will capture more value than siloed operators. Third, regulatory frameworks that combine producer responsibility with incentives for reuse will accelerate investment. Finally, as volumes of retired batteries rise through the late 2020s and into the 2030s, economies of scale and learning-by-doing should drive down remanufacturing costs and make refurbished packs a routine option for many fleets and some consumer segments.

Battery remanufacturing for NEVs is transitioning from experiment to industrial practice. It addresses urgent environmental concerns, offers pathways to reduce dependence on virgin mineral extraction, and provides cost relief to commercial operators while posing complex technical, logistical, and regulatory challenges. The businesses and policies that succeed will combine robust diagnostics, safe and standardized disassembly, reliable core sourcing, supportive regulation and transparent data systems. When these elements align, remanufacturing becomes not only feasible but a powerful lever for circular mobility — closing material loops, lowering lifecycle emissions, and extending the utility of each battery pack in an era when resource efficiency is as critical as technological innovation.