2026 ACEA’s report, remanufacturing always at the forefront

Cultural, economic, and infrastructural differences across EU member states

Passenger cars alone reached approximately 256 million units in 2024, representing an increase of around 1.4 % compared to the previous year. This growth underscores that, despite broader efforts to reshape mobility patterns, private motorized transport remains deeply entrenched in everyday life across Europe. Italy once again stands out in the report for its particularly high level of vehicle ownership. Expressed per thousand inhabitants, Italy has among the highest concentrations of cars in the EU, well above the European average and far exceeding figures recorded in countries such as Latvia at the lower end of the scale.

These ownership patterns reflect cultural, economic, and infrastructural differences across EU member states, with some countries maintaining highly car-dependent transport systems while others register lower vehicle density. While the total volume of vehicles has increased, the data reveal a fleet that is aging and changing only slowly in terms of technological composition. The average age of passenger cars in the EU has risen to about 12.7 years, up from 12.5 years the year before.

This trend is indicative of consumers retaining older vehicles for longer periods, perhaps driven by economic considerations, supply constraints on new models, or a mismatch between regulatory pressure and customer incentives. Countries such as Greece and Italy present extreme examples of this ageing phenomenon, with average car ages significantly above the EU mean, pointing to structural and socio-economic factors that influence vehicle replacement cycles.

Commercial vehicles, vans, and trucks: a growing market

Commercial vehicles, including vans and trucks, display similar patterns of slow technological turnover. There are roughly 31.1 million vans operating on EU roads, with an increase of nearly 1.9 % in 2024 compared with the prior year. However, only about 1.3 % of these vans are electrically chargeable, highlighting how the shift toward alternative powertrains in this segment remains in its early stages.Trucks, numbering approximately 6.2 million across the Union, increased by about 0.9 %, but electrification remains marginal at close to just 0.3 % of the total. These heavier vehicles also tend to be older; on average, trucks are about 14 years old, making them the oldest category in the entire vehicle fleet.

A drop in the Ocean

Buses show a slightly more encouraging picture in terms of electrification, though they still represent a small fraction of the overall fleet. The number of buses increased by roughly 1.8 % in 2024, and around 3.5 % of these are electrically chargeable. Interestingly, in a few EU countries — notably Denmark, Luxembourg, the Netherlands, and Sweden — battery-electric buses already comprise more than 10 % of the total bus stock, signalling how targeted policies and municipal efforts can accelerate the uptake of zero-emission solutions in public transport.Taken together, these findings draw attention to the gulf that persists between the ambitions of European climate and mobility policy and the actual pace of change within the vehicle fleet.

Passenger cars, electrification is not taking off

Electrically-chargeable passenger cars are increasing in number — moving from 3 % to about 3.7 % of the total fleet in 2024 — but this still represents a small share relative to the total population of vehicles. Even though battery-electric vehicles (BEVs) and plug-in hybrids are becoming more visible among new registrations and are gaining market traction in some markets, their presence on the road remains limited in absolute terms because the total fleet is so large and replacement cycles are slow.The report’s figures on electrification stand in contrast with other ACEA and industry data showing robust BEV sales growth in recent years and significant year-on-year increases in new electric registrations — a trend that underscores the difference between new-vehicle markets and the overall installed base. While new BEV sales represent a growing share of annual sales, this dynamic has yet to be fully reflected in fleet composition because newly sold vehicles add to rather than replace the existing stock at a rapid pace.

This lag phenomenon means that even sharp increases in electric vehicle sales today will take many years to significantly transform the overall fleet makeup. The slow pace of electrification and the ageing of vehicles have broader implications for Europe’s environmental and energy goals. Road transport continues to be a major contributor to greenhouse gas emissions, and if the existing fleet remains dominated by older, internal-combustion vehicles, emissions reductions from new registrations will be offset to some extent by continued use of less efficient, higher-emission vehicles.

Policymakers and industry stakeholders often highlight the need for a comprehensive ecosystem approach — including more extensive charging infrastructure, stronger incentives for cleaner vehicles, and fiscal measures that accelerate fleet renewal — to complement regulatory mandates. This multifaceted strategy is seen as essential to bridging the gap between long-term policy targets and the current reality on Europe’s roads.

The electric transition depends on several factors

It is also important to consider the diversity of conditions and policy environments within the single market. Some countries exhibit relatively youthful fleets with emerging electrification niches, while others struggle with particularly ancient vehicle stocks.This heterogeneity underscores that the EU’s transition to low-carbon mobility is not a uniform process; rather, it is shaped by national economic contexts, consumer preferences, infrastructure readiness, and the interplay between local and EU-wide policy frameworks. Efforts at the European level to harmonize standards and support deployment of alternative fuel infrastructure must therefore account for these varied starting points.

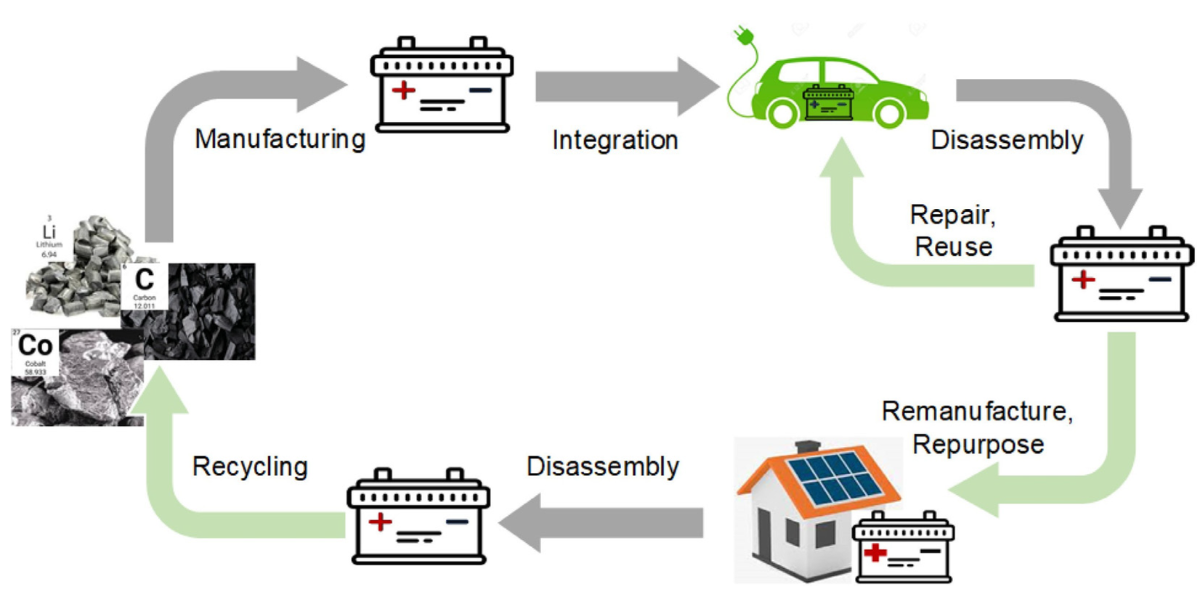

Havana effect and the future of remanufacturing

The average age of passenger cars in the EU has risen to about 12.7 years, up from 12.5 years the year before. The data, relating to the steadily increasing average age of cars on the market—predominantly ICE vehicles—open up a particularly interesting perspective on remanufacturing.Despite the advent of electric cars, whose spread is inevitable but still far from the sales volumes once expected at this stage, ICE vehicles will remain the main field of activity for remanufacturing and the entire aftermarket supply chain for decades to come, especially in those countries where, as seen, the “Havana effect” is increasingly becoming a reality.

This scenario is further reinforced by the European Commission’s decision to halt the ban on the sale of ICE vehicles planned for 2035. From 2035 onwards, in fact, carmakers will need to comply with a 90% tailpipe emissions reduction target, while the remaining 10% emissions will need to be compensated through the use of low-carbon steel Made in the Union, or from e-fuels and biofuels. This will allow for plug-in hybrids (PHEV), range extenders, mild hybrids, and internal combustion engine vehicles to still play a role beyond 2035, in addition to full electric (EVs) and hydrogen vehicles.

In light of the facts, the increasing number of vehicles and the persistence of internal combustion engines reflect deep-seated patterns of use and investment. At the same time, the gradual rise of electrically chargeable vehicles offers a glimpse of the transformative potential of new technologies.

As a result, Europe’s longer-term climate and mobility goals will require sustained effort across multiple fronts, including policy evolution, incentives for consumers, expanded infrastructure, and continued automotive industry innovation. Only by addressing these complex, interlinked challenges can the European vehicle fleet evolve toward a cleaner, more efficient, and more sustainable future.