Heavy-duty remanufacturing

Supply chain volatility

One of the most powerful drivers reshaping the heavy-duty remanufacturing field has been supply chain volatility. Global disruption in the supply of new parts—stemming from semiconductor shortages, logistics bottlenecks, and fluctuating raw material prices—has underscored the economic vulnerability of heavy-duty fleet operators. These pressures have nudged fleets and service providers to reconsider remanufactured components not as fallback options but as reliable, cost-competitive alternatives.In many cases, remanufactured engines or transmissions offer lead times that are significantly shorter than new replacements, and total lifecycle costs that are lower when both acquisition price and downtime are accounted for. This shift has expanded the market beyond traditional independent remanufacturing shops to include OEMs and large tier suppliers investing in remanufacturing capabilities.

Sustainability and regulatory compliance

Another pivotal force is the push for sustainability and regulatory compliance. Heavy-duty vehicles are a major source of greenhouse gas emissions and air pollutants worldwide, prompting regulators to tighten emissions standards and enforce stricter lifecycle analysis of automotive parts. In response, remanufacturing has emerged as a powerful tool to reduce environmental impact, because reusing existing hardware dramatically lowers material extraction, energy consumption, and waste generation compared to producing new components.Heavy-duty remanufactured parts can deliver up to 70-90% reductions in energy use and emissions over new manufacturing for equivalent items—a compelling statistic that resonates with fleet managers aiming to meet ESG (environmental, social, governance) goals. As sustainability reporting becomes more sophisticated, companies are increasingly quantifying the carbon savings attributed to remanufactured parts as part of broader decarbonization strategies.

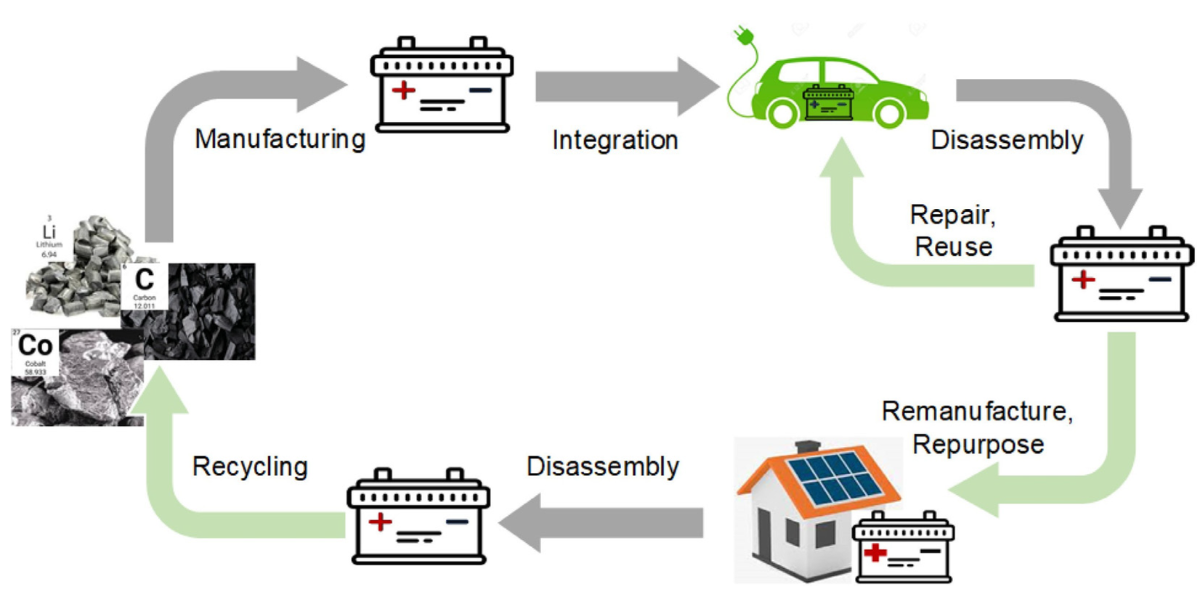

The advent of electrification

Electrification is also beginning to influence the heavy-duty remanufacturing landscape, although its full impact is still unfolding. While fully electric heavy trucks are not yet widespread in comparison with passenger electric vehicles, hybrid and electrified systems are gaining traction among commercial fleets. This transition introduces new components such as high-voltage batteries, electric motors, and power electronics into the remanufacturing mix.Unlike traditional engines and transmissions, these systems pose novel challenges: for instance, battery packs require specialized diagnostic tools to assess cell health, balance issues, and remaining useful capacity. Electric motors and inverters involve high-precision electronics and thermal management systems that demand different remanufacturing skill sets than conventional mechanical parts.

The importance of new technologies

In response, remanufacturers are investing in new technologies and training. Advanced testing equipment—capable of simulating real-world duty cycles and conducting comprehensive performance validation—is becoming standard in leading remanufacturing facilities.Infrared imaging, automated diagnostic platforms, laser scanning, and cloud-connected test benches are helping to ensure that remanufactured heavy-duty components meet or exceed original performance specifications. These tools not only enhance quality assurance but also enable more granular tracking of component histories—a capability that becomes especially valuable as vehicles and parts enter second or even third life cycles.

Digitization, IoT platforms, and AI

Digitization and data analytics are likewise exerting a growing influence. The increasing connectivity of heavy-duty vehicles, through telematics and IoT (Internet of Things) platforms, means that operational data can be harnessed to predict failure modes before they occur.This predictive maintenance approach benefits remanufacturing in two major ways: it improves the timing of component recovery by pinpointing when cores will be available, and it informs remanufacturers about typical wear patterns, enabling them to refine refurbishment processes and optimize part inventories. Some advanced remanufacturing operations now integrate AI-driven forecasting models that help balance supply and demand for cores—critical for maintaining throughput and financial viability.

The collaboration OEMs - IRs

From a market perspective, the heavy-duty remanufacturing sector is also seeing greater collaboration between OEMs and independent specialists (IRs). In the past, remnants of unease between original manufacturers and third-party remanufacturers persisted, rooted in concerns over quality, warranty obligations, and brand protection. Today, these boundaries are softening.

Many OEMs have established in-house remanufacturing programs or partnered with certified remanufacturers to ensure consistent quality standards while capturing value that might otherwise be lost to the aftermarket. This has the dual effect of expanding customer confidence in remanufactured parts and creating a broader ecosystem that can support higher volumes.

Economic factors continue to underpin interest in remanufacturing. Fleet operators are under constant pressure to reduce total cost of ownership, especially in sectors like long-haul trucking, construction, and mining where equipment utilization is high and downtime is expensive.

Remanufactured components offer a compelling value proposition: they often come with robust warranties, substantial cost savings relative to new parts, and performance that closely approximates original specifications. When combined with improved testing and quality assurance methods, this value proposition has strengthened the market’s position.

New challenges await heavy-duty remanufacturing

Despite these advances, challenges remain. Heavy-duty remanufacturing must grapple with standardization issues, especially for newer electrified components that lack established refurbishment protocols. The need for highly skilled labour—competent in both mechanical and electronic systems—is acute, and workforce development remains a strategic priority for the industry.Moreover, as vehicles become smarter and more software-dependent, remanufacturers will need secure access to diagnostic software and firmware updates to ensure comprehensive restoration—a point that sometimes involves negotiations over intellectual property and licensing.

The latest scenario in heavy-duty automotive remanufacturing reflects a dynamic interplay of economic, environmental, and technological drivers. Remanufacturing has evolved from an ancillary aftermarket niche to a core strategy that enhances sustainability, mitigates supply chain risk, and delivers measurable value to fleets and OEMs alike.

As electrification advances and digital tools proliferate, the sector is poised for further growth—provided it can adapt to the complexities of new propulsion systems and the demands of a data-driven operational environment.