Micro-duty remanufacturing

This term is not yet universally defined, but it generally refers to remanufacturing practices applied to smaller, lighter, urban-oriented mobility solutions such as electric bicycles (e-bikes), electric scooters (e-scooters), and other micro-mobility vehicles that share technical and sustainability challenges with traditional automotive components.

What makes this segment distinct from traditional remanufacturing is both the scale and the nature of the products involved: they are often compact, highly integrated electric/mechanical systems designed for short-range use, high turnover, and frequent urban deployment. Consequently, remanufacturing in this category pushes the boundaries of design, sustainability, and business modeling in ways that are increasingly relevant to the broader automotive remanufacturing industry.

A solution that has now become a must in the city

At the core of micro-duty remanufacturing’s rising visibility is the surging diffusion of micro-mobility solutions. As cities worldwide embrace electric two-wheelers and scooters to reduce emissions and ease congestion, the number of units in circulation has skyrocketed, creating a vast potential pool of material and components for refurbishment and reuse.Unlike heavy-duty vehicles or even standard passenger cars, these micro-duty vehicles are subject to intense wear cycles in urban settings, meaning parts such as batteries, motors, controllers, and chassis components often need servicing or replacement early in their life cycle. This has prompted industry actors to rethink remanufacturing not just as a niche aftermarket service, but as an essential part of a sustainable mobility ecosystem.

Design complexity and electrification

One of the principal challenges in micro-duty remanufacturing is design complexity. E-bikes and e-scooters integrate electrical, mechanical, and software systems in tight, lightweight packages. Traditional bicycle remanufacturing focused mainly on mechanical components like frames and wheels.With electrification, the inclusion of battery packs, power electronics, and embedded software introduces layers of complexity that require new standards for disassembly, testing, and refurbishment. As a result, remanufacturers are advocating for design for remanufacturing principles—modular components, standardized interfaces, and easily replaceable subassemblies.

When micro-duty vehicles are designed with remanufacturing in mind, it becomes far easier to disassemble and refurbish individual parts, reducing waste and lowering total lifecycle costs.

Battery design and lifecycle management

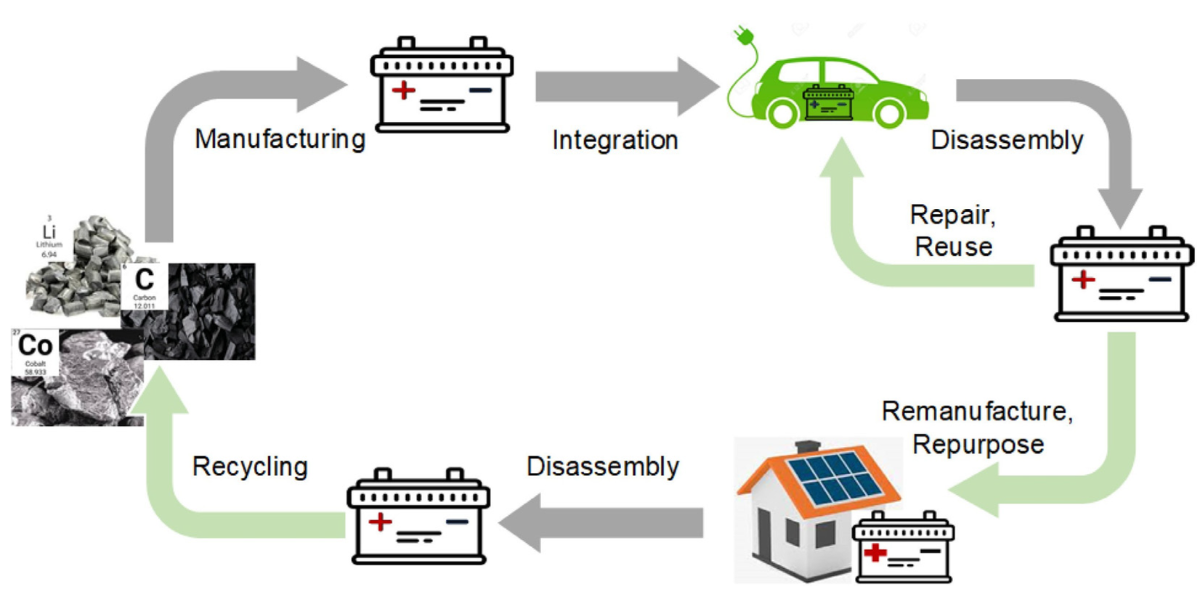

Another area where micro-duty remanufacturing is making strides is in battery design and lifecycle management. Batteries represent the most valuable and environmentally sensitive components of any electric mobility vehicle. Micro-duty remanufacturing initiatives emphasize batteries that are easy to remove, inspect, and refurbish.

Batteries with accessible cells or modular architecture allow technicians to replace worn cells or upgrade to newer chemistries without scrapping the entire pack. This not only reduces waste but also extends the useful life of battery systems—potentially mitigating pressure on raw materials like lithium, cobalt, and nickel that are critical to broader automotive supply chains./

Software plays an increasingly significant role

Unlike mechanical parts, software can be updated, reconfigured, or optimized without physical intervention. For micro-duty remanufacturing, this means that upgrading firmware, recalibrating control algorithms, or optimizing battery management systems can substantially improve performance and extend operational life without replacing hardware.

This is a notable departure from traditional automotive remanufacturing, where mechanical rebuilding has tended to dominate. The growing importance of digital systems underscores the need for remanufacturers to develop integrated capabilities in both hardware and software diagnostics.

In practice, take-back and reuse programs are becoming more common. Some manufacturers and mobility service providers are beginning to implement trade-in schemes where end-of-life micro-duty vehicles are returned, assessed, and either remanufactured or used as cores for refurbishment.

These programs close the loop on product life cycles and feed remanufacturing operations with a steady stream of input units, helping to ensure a reliable supply of cores—which are essential to remanufacturing economics.

AI, IoT, predictive diagnostics, and blockchain traceability

While the concept of micro-duty remanufacturing has a special emphasis on smaller mobility gear, it is also informing broader trends in the automotive remanufacturing market. The entire industry is experiencing digitalization, advanced manufacturing, and sustainability pressures that align well with lessons learned from the micro-duty sector.

Technologies such as IoT connectivity, predictive diagnostics, AI-assisted quality inspection, and blockchain traceability are being deployed across remanufacturing facilities to enhance efficiency, quality control, and supply chain transparency. These tools allow for real-time monitoring of component health, better forecasting of failure modes, and more efficient sorting and processing of cores—factors that are vital for scaling remanufacturing operations beyond niche applications.

The role of the European Union

At the regulatory level, policies promoting circular economy practices are catalyzing investment in remanufacturing. Recent European Union proposals aim to make vehicles easier to disassemble and reuse components, require higher recycled content in new vehicles, and strengthen producer responsibility for end-of--life treatment. Although these regulations are broad in scope, their influence trickles down to micro-duty vehicles as well, encouraging manufacturers to adopt design and lifecycle practices that facilitate remanufacturing and reuse across all vehicle categories.

Consumer perception is another important dimension. Increasing awareness of environmental issues and the cost advantages of remanufactured parts is helping to normalize the purchase of restored components. This shift in attitude not only supports the micro-duty segment but also bolsters confidence in remanufactured products for larger automotive applications. Efforts by OEMs to integrate remanufacturing into their core business models, often in partnership with third-party specialists, are further enhancing the legitimacy of the remanufactured parts market.

Concluding our analysis, while micro-duty remanufacturing may have started at the periphery of the larger automotive sector, it is rapidly becoming a testbed for innovation. The challenges of modular design, battery lifecycle management, software integration, and sustainable business models are shaping how the broader remanufacturing industry evolves.

As cities continue to embrace micro-mobility and as the automotive world at large shifts toward electrification and circular economy principles, micro-duty remanufacturing stands as a compelling example of how sustainability and economic opportunity can intersect and drive future growth.