Software and digitalisation in the automotive field

Monday, 1 December 2025

Software and digitalisation have become the silent engines reshaping the entire automotive remanufacturing landscape, pushing it far beyond the traditional image of dusty workshops and mechanical benches. What used to be almost entirely a hands-on, manual craft has evolved into a hybrid world where algorithms, cloud platforms, data pipelines, and simulation tools are as essential as torque wrenches.

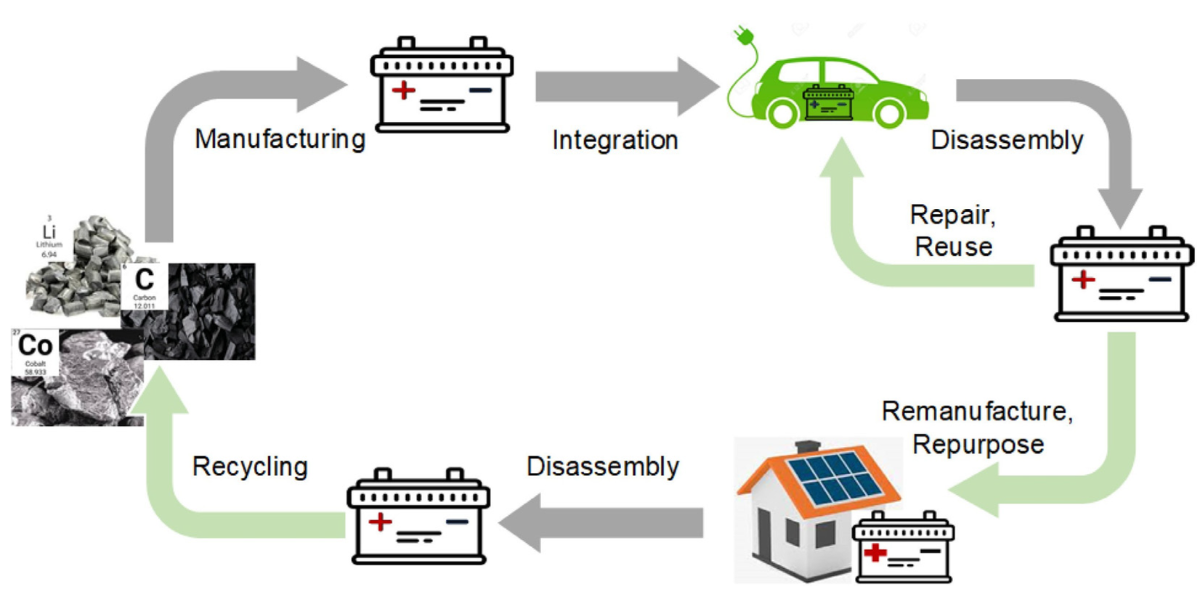

This shift isn’t just a gentle technological refresh; it’s a structural transformation of how components are evaluated, restored, validated, tracked, and integrated back into the circular economy. What makes automotive remanufacturing particularly interesting is that it sits at the intersection of sustainability goals, economic pressures, and rapid changes in vehicle technologies. Digitalisation is becoming the only way for businesses to bridge older processes with increasingly complex components — especially as electric drivetrains, ADAS modules, and highly digitized control systems become the norm.

In many ways, automotive remanufacturing is one of the sectors most ripe for digital transformation because of its built-in challenges: inconsistent cores, fragmented supply chains, unpredictable failure modes, and extremely tight cost margins. Every core unit arriving from the market has lived a completely different life — different loads, environments, maintenance histories, and failure conditions. Traditional approaches relied heavily on the expertise and intuition of technicians, and while that’s still valuable, software tools now capture and amplify this expertise by mapping patterns, predicting failure behaviour, and maintaining consistent quality.

Digital core management systems, for example, allow companies to track every component from the moment it enters the facility. Serial numbers, teardown observations, cleaning results, diagnostic logs, and historical data from previous batches are all recorded digitally. These systems not only improve traceability but also help optimize inventory, letting companies understand which components are worth remanufacturing and which are better suited for recycling.

with these units, scan firmware versions, and perform functional simulations that mimic real-world automotive environments. Instead of physically installing a remanufactured ECU into a test vehicle, hardware-in-the-loop (HIL) systems and digital twins can replicate signals from sensors, actuators, and CAN networks. This dramatically reduces testing time, improves safety, and cuts down on resource consumption. It also allows remanufacturers to detect subtle software-related issues that were previously impossible to catch without real-vehicle testing.

The resulting data allows companies to publish environmental impact reports, participate in carbon credit programs, or secure greener supply chain certifications. Many automotive brands outsource remanufacturing to specialised companies, and digital transparency strengthens trust between OEMs and remanufacturers. When an OEM can see live dashboards showing yield rates, quality control results, emissions savings, and shipment statuses, the partnership becomes more collaborative and forward-looking.

This shift isn’t just a gentle technological refresh; it’s a structural transformation of how components are evaluated, restored, validated, tracked, and integrated back into the circular economy. What makes automotive remanufacturing particularly interesting is that it sits at the intersection of sustainability goals, economic pressures, and rapid changes in vehicle technologies. Digitalisation is becoming the only way for businesses to bridge older processes with increasingly complex components — especially as electric drivetrains, ADAS modules, and highly digitized control systems become the norm.

In many ways, automotive remanufacturing is one of the sectors most ripe for digital transformation because of its built-in challenges: inconsistent cores, fragmented supply chains, unpredictable failure modes, and extremely tight cost margins. Every core unit arriving from the market has lived a completely different life — different loads, environments, maintenance histories, and failure conditions. Traditional approaches relied heavily on the expertise and intuition of technicians, and while that’s still valuable, software tools now capture and amplify this expertise by mapping patterns, predicting failure behaviour, and maintaining consistent quality.

Digital core management systems, for example, allow companies to track every component from the moment it enters the facility. Serial numbers, teardown observations, cleaning results, diagnostic logs, and historical data from previous batches are all recorded digitally. These systems not only improve traceability but also help optimize inventory, letting companies understand which components are worth remanufacturing and which are better suited for recycling.

The importance of diagnostics

One of the biggest shifts comes from diagnostics. Vehicles today are equipped with dozens of control units, hundreds of sensors, and complex software architectures that define how the whole car moves, communicates, and protects passengers. Remanufacturers now deal with ECUs not as simple electronic units but as software-driven systems with embedded security protocols, firmware variations, and vehicle-specific configurations. Digital tools allow technicians to interfacewith these units, scan firmware versions, and perform functional simulations that mimic real-world automotive environments. Instead of physically installing a remanufactured ECU into a test vehicle, hardware-in-the-loop (HIL) systems and digital twins can replicate signals from sensors, actuators, and CAN networks. This dramatically reduces testing time, improves safety, and cuts down on resource consumption. It also allows remanufacturers to detect subtle software-related issues that were previously impossible to catch without real-vehicle testing.

How optimize the remanufacturing process using digital twins

Speaking of digital twins, they’re becoming one of the most fascinating technologies in the field. A digital twin is essentially a virtual replica of a component or system, fed by real data and capable of simulating performance under different scenarios. In remanufacturing, digital twins can help engineers analyse wear patterns, identify failure hotspots, and optimize the remanufacturing process long before the physical work begins. If a batch of electric vehicle inverters shows a common failure mode related to thermal stress, the digital twin can simulate how different replacement strategies, coatings, or assembly techniques might improve durability. This means remanufacturers don’t just restore components — they often upgrade them based on insights extracted from data. In a world moving toward more sustainable practices, the ability to extend the life of components while improving performance is a major competitive advantage.EVs vs ICVs, a different technological approach

Electric vehicles in particular have accelerated the need for more advanced digital tools. Traditional powertrain components like alternators and starters have long been remanufactured with stable processes. But EVs introduce high-voltage batteries, power electronics, thermal management modules, and complex vehicle control systems that require sophisticated testing environments and extremely precise software tools. Battery remanufacturing is a perfect example: digital BMS (Battery Management System) diagnostics can read cell-level performance data, cycle histories, temperature profiles, and internal resistance values. Machine learning models can then predict which modules are suitable for remanufacture, which can be reconditioned, and which should be routed to second-life applications. Without software-driven diagnostics, remanufacturing EV batteries would be almost impossible to scale safely and economically.The role of IoT

Another powerful layer of digitalisation comes from industrial IoT (IoT). Modern remanufacturing facilities use sensor networks to monitor machinery health, track energy consumption, and automate quality assurance processes. Vibration sensors monitor bearing wear in cleaning equipment; thermal cameras check curing temperatures for coatings; smart torque tools log every fastener tightening operation in real time. This level of data collection helps prevent errors and supports full traceability — something increasingly demanded by OEMs and regulatory bodies as remanufacturing enters more safety-critical domains. When each step of a process is logged digitally, quality managers can instantly generate compliance reports, investigate anomalies, or run big-picture analyses that reveal inefficiencies. And because most IoT systems connect to cloud platforms, remote monitoring and predictive maintenance become standard practice. Instead of waiting for a machine to break and halt production, software now anticipates failures and schedules interventions ahead of time.Supply chain digitalisation, another critical piece of the puzzle

Automotive remanufacturing depends on a steady flow of cores, and disruptions can be crippling. Core availability has always been unpredictable, often relying on manual arrangements, inconsistent return policies, or vague contractual obligations. Digital core tracking platforms, often integrated with blockchain or distributed ledger technologies, now ensure that every core’s movement is recorded transparently. Manufacturers, logistics partners, and remanufacturers can all see where components are, when they’re expected to arrive, and what condition they're reported to be in. This not only reduces disputes but also allows companies to plan production schedules more accurately. When combined with automated demand forecasting tools, companies can anticipate shortages, adjust procurement strategies, and communicate more effectively with customers.Software platforms and sustainability metrics

A lot of the sector’s digital transition is also driven by sustainability metrics. Regulators and customers increasingly demand evidence: carbon footprints, material recovery rates, energy consumption, waste reductions, and lifecycle performance improvements. Software platforms make it feasible to calculate these metrics with real precision. Every step in the remanufacturing process — from cleaning solvents to electricity for test benches — can be tracked digitally.The resulting data allows companies to publish environmental impact reports, participate in carbon credit programs, or secure greener supply chain certifications. Many automotive brands outsource remanufacturing to specialised companies, and digital transparency strengthens trust between OEMs and remanufacturers. When an OEM can see live dashboards showing yield rates, quality control results, emissions savings, and shipment statuses, the partnership becomes more collaborative and forward-looking.